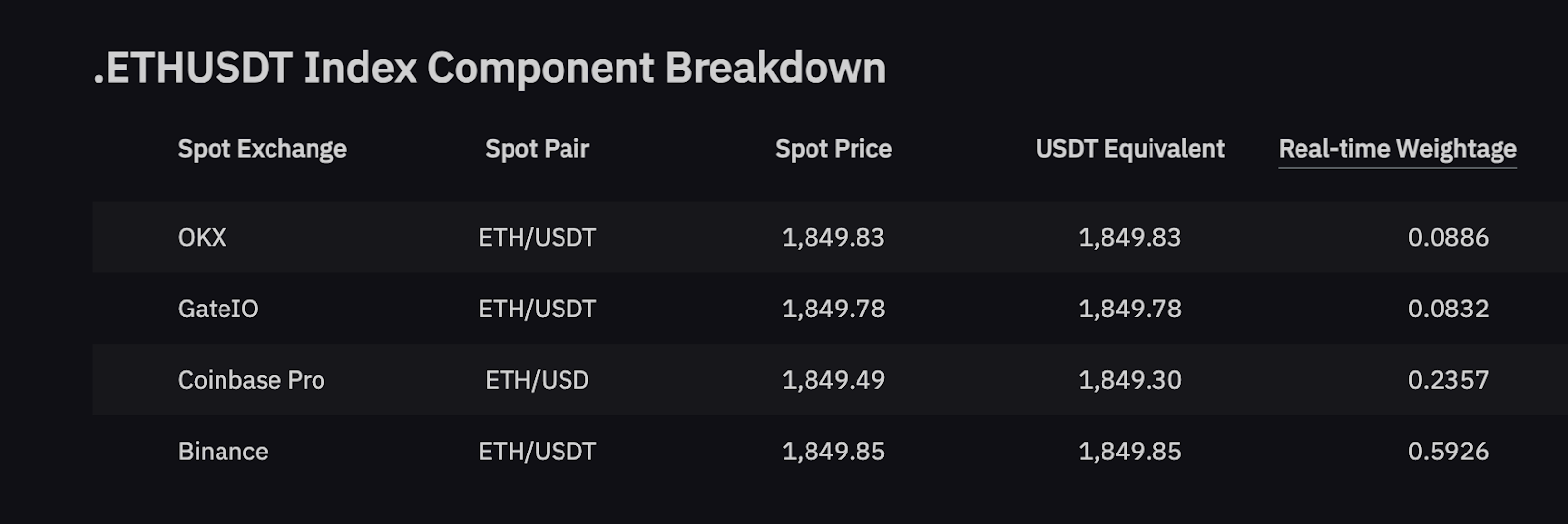

The index price is the sum of the prices of the top six (6) Spot trading pairs on the major Spot exchanges by trading volume, multiplied by the respective weights of the Spot trading pairs (The symbol — .XXXUSDT, XXX — is represented by the respective coin's abbreviations, such as BTC, ETH, XRP or A.). Index Price can be obtained from the underlying data pages for the Inverse Contract and USDT Perpetual Contract, respectively.

The index price depends on three (3) variables: Current Quote, USDT-Paired Equivalent and Real-time Weight.

Current Quote

This figure represents the current live price quoted directly from the respective Spot exchanges for the underlying coin asset.

USDT-Paired Equivalent

This data represents the price of Spot trading pairs converted into USDT trading pairs, based on the current quote.

Example

Let's consider a scenario where the ETHUSDT index includes a component from Exchange A using the trading pair ETH/BTC, with a current quote of 0.1. If the current BTC/USDT price on the Bybit stands at $20,000. In this case, the USDT-paired equivalent value is $2,000 based on the following calculation:

Current Quote × BTC/USDT = 0.1 × 20,000

Real-time Weight

The Index Price is calculated by summing the weighted prices of Spot trading pairs from top global Spot exchanges. The weight, known as Trade_WtO, is based on the 24-hour trading volumes of the six (6) leading Spot trading pairs. This weight is then applied to the current quote price to determine its impact on the overall Index Price. For clarity, we'll refer to the platforms as A, B, C, D, E, and F in the following examples.

Note: The index weights are updated hourly.

Index Price Calculation

The calculation formula is as follows:

Index Price = (Spot Price_Symbol A × Trade_WtO_Symbol A) + (Spot Price_Symbol B × Trade_WtO_Symbol B) + (Spot Price_Symbol C × Trade_WtO_Symbol C) + (Spot Price_Symbol D × Trade_WtO_Symbol D) + (Spot Price_Symbol E × Trade_WtO_Symbol E) + (Spot Price_Symbol F × Trade_WtO_Symbol F)

- Trade_WtO_Symbol A = 24-Hour Trading Vol. Symbol (A)/[24-Hour Trading Vol. Symbol (A) + 24-Hour Trading Vol. Symbol (B) + 24-Hour Trading Vol. Symbol (C) + 24-Hour Trading Vol. Symbol (D) + 24-Hour Trading Vol. Symbol (E) + 24-Hour Trading Vol. Symbol (F)]

To ensure stability in the index price during market volatility, we've introduced a price protection mechanism:

1. If the Spot price of any component trading platform diverges by more than 5% from the median of all Spot price sources, the system will temporarily exclude the respective component from index price calculation (during the exclusion period, the original component’s weight is gradually reduced using a smoothing algorithm and redistributed among the remaining non-excluded components. The smoothing process is determined by the price deviation between the excluded component and the index price), until its price lies within 5% of all Spot prices' median. However, this rule doesn't apply to certain designated trading pairs or to trading pairs for which Bybit has specially adjusted the median deviation thresholds (Eg: BTC & ETH is 1%).

2. When calculating the median, all exchanges with non-zero weights are included in the calculation, regardless of whether they have been excluded from the index calculation. In extreme scenarios, if the spot prices of all exchanges deviate from the mid-price by more than 5%, the weights of the excluded exchanges will be smoothly redistributed to the remaining included exchanges until only one exchange is left (components that deviate from the median earlier will be excluded first).

3. When an index component deviates from the median price beyond the threshold (generally 5%), it will be excluded from the median calculation pool. However, the component may be reintroduced into the median calculation pool if it meets one of the following conditions:

- The index component includes at least one of the following exchanges (Binance, OKX, Bybit, Coinbase), the prices converge with other components, and the volume-based weighted sum is ≥ 55% (Applicable only to native components denominated in USDT, USDC, or USD).

- The index component includes at least two of the following exchanges (Bitget, Gate, MEXC), the prices converge with other components, and the volume-based weighted sum is ≥ 55% (Applicable only to native components denominated in USDT, USDC, or USD).

4. To remove trading pairs that are suffering from liquidity issues or experiencing a service disruption, if no Spot trading pair has been traded on the exchange for more than 15 minutes, the trading pair will be excluded from both the index price calculation and the median calculation pool. Once trading activities resume, they will once again be re-included in the index price calculation and the median calculation pool.

5. In extreme market conditions or abnormal currency pair price fluctuations, Bybit reserves the right to adjust the price source, weights or weight caps without prior notification.

Example

Let’s assume that the BTC Spot prices and trading volume weights for six (6) trading pairs are as follows:

The.BTCUSDT index price is $20,052.95 based on the following calculation:

Index Price = ($20,046 × 20%) + ($20,048 × 15%) + ($20,056 × 20%) + ($20,058 × 15%) + ($20,060 × 15%) + ($20,051 × 15%)

Index Price Calculation in Extreme Market Conditions

In certain extreme market conditions, Bybit may be unable to obtain a reasonable spot price from any exchange, including its platform. To ensure the rationality of the index price under such circumstances, the index price will be calculated from the last traded price of the Perpetual Contract.

Formula

The index price is determined using the target price taken every second over the past 10 seconds.

The calculation formula for the index price at time Tn is:

Index Price at Tn = α × Target Price at Tn + (1−α) × Index Price at Tn−1

Currently, α defaults to 0.1818, but it will be adjusted based on market conditions.

Target Price Calculation

The target price is calculated once every second, considering the target price of the Perpetual Contract under two (2) scenarios:

- No Active Orders for Buy or Sell:

- Target Price = Last Traded Price

- Active Orders Exist for Buy and Sell:

- Target Price = Adjusted Depth-Weighted Mid-Price

Adjusted Depth-Weighted Mid-Price Calculation

The adjusted depth-weighted mid-price calculation involves four (4) steps:

Step 1: Calculate the Bottom Volume of the Premium Index

- For USDT Perpetual, USDC Perpetual and USDC Futures Contracts

Premium Index Bottom Volume = Roundup [Impact Margin Notional / Last Traded Price × Minimum Order Quantity, 0] × Minimum Order Quantity

- For Inverse Perpetual Contracts:

Premium Index Bottom Volume = Impact Margin Notional

For the real-time impact margin notional of each Perpetual Contract, please refer to the Funding Rate page.

Step 2: Calculate the Depth-Weighted Bid and Ask Prices

- For USDT Perpetual, USDC Perpetual and USDC Futures Contracts

Example

a) Assuming that the bottom volume of the premium index is 30 XYZ, the depth-weighted ask price is calculated as follows:

- Depth-Weighted Ask Price = (100 × 5 + 101 × 10 + 102 × 15) / 30 = 101.33 XYZ/USDT

b) If the bottom volume of the premium index is 40 XYZ:

- Depth-Weighted Ask Price = (100 × 5 + 101 × 10 + 102 × 15 + 103 × 10) / 40 = 101.75 XYZ/USDT

- For Inverse Perpetual Contracts

Example

- Assuming that the bottom volume of the premium index is 50 USD, the depth-weighted ask price is:

50 / 0.490243482 = 101.99 XYZ/USD

Step 3: Ensure Depth-Weighted Mid-Price Reasonability

To ensure the depth-weighted mid-price does not deviate excessively from the bid or ask prices, apply the following adjustments:

- Adjusted Depth-Weighted Bid Price = Max (First Bid Price × 0.98, Depth-Weighted Bid Price)

- Adjusted Depth-Weighted Ask Price = Min (First Ask Price × 1.02, Depth-Weighted Ask Price)

Step 4: Calculate the Adjusted Depth-Weighted Mid-Price to execute the Impact Margin Notional

Adjusted Depth-Weighted Mid-Price = (Adjusted Depth-Weighted Bid Price + Adjusted Depth-Weighted Ask Price) / 2

Index Price Calculation for Pre-Market Perpetual Contracts

The index price calculation method for Pre-Market Perpetual Contracts varies based on the trading phase:

- During the Call Auction Phase:

Index Price = Estimated Opening Price

- During the Continuous Auction Phase:

The index price is calculated using the same method as the standard Perpetual Contract under extreme circumstances, as detailed above.