Trailing Stop in Perpetual & Futures trading is a powerful tool to dynamically manage risk without constant monitoring of price movements. It operates as a stop order that tracks the market price of an asset or position and automatically adjusts the stop order to minimize loss or lock in profits as the price moves in the trader's favor. Once the Trailing Stop is determined, if the market price reaches a certain level and then retraces back by a predetermined amount set by the user, a market order will be triggered.

Note:

For Bybit App users, please note that the Trailing Stop feature is only available in App version 4.37.0 and above.

How Does It Work?

The Trailing Stop order functions similarly for Spot, Margin, Perpetual, and Futures trading. The primary distinction lies in its application: while the Trailing Stop order can be utilized for both Buy and Sell orders in Spot & Margin trading, it is solely available as a closing strategy for opened positions in Perpetual and Futures trading. For more information on how to place Buy and Sell orders with Trailing Stop, please refer to this article.

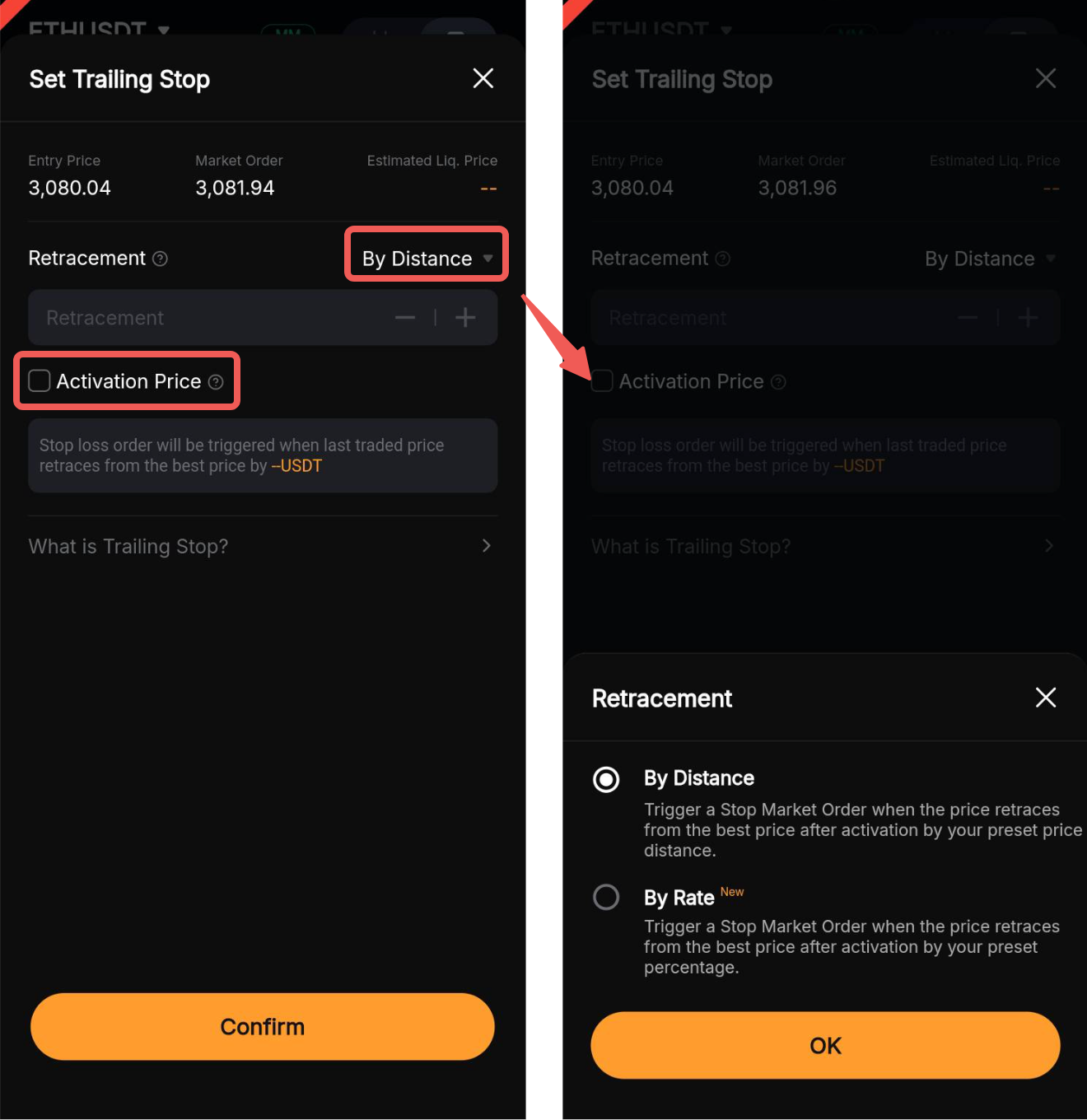

You can set your Trailing Stop order in two (2) ways:

- By Distance: Price retracement in terms of price distance from the best price recorded since activation.

- By Rate (or Percentage): Price retracement in terms of percentage from the best price recorded since activation.

Examples

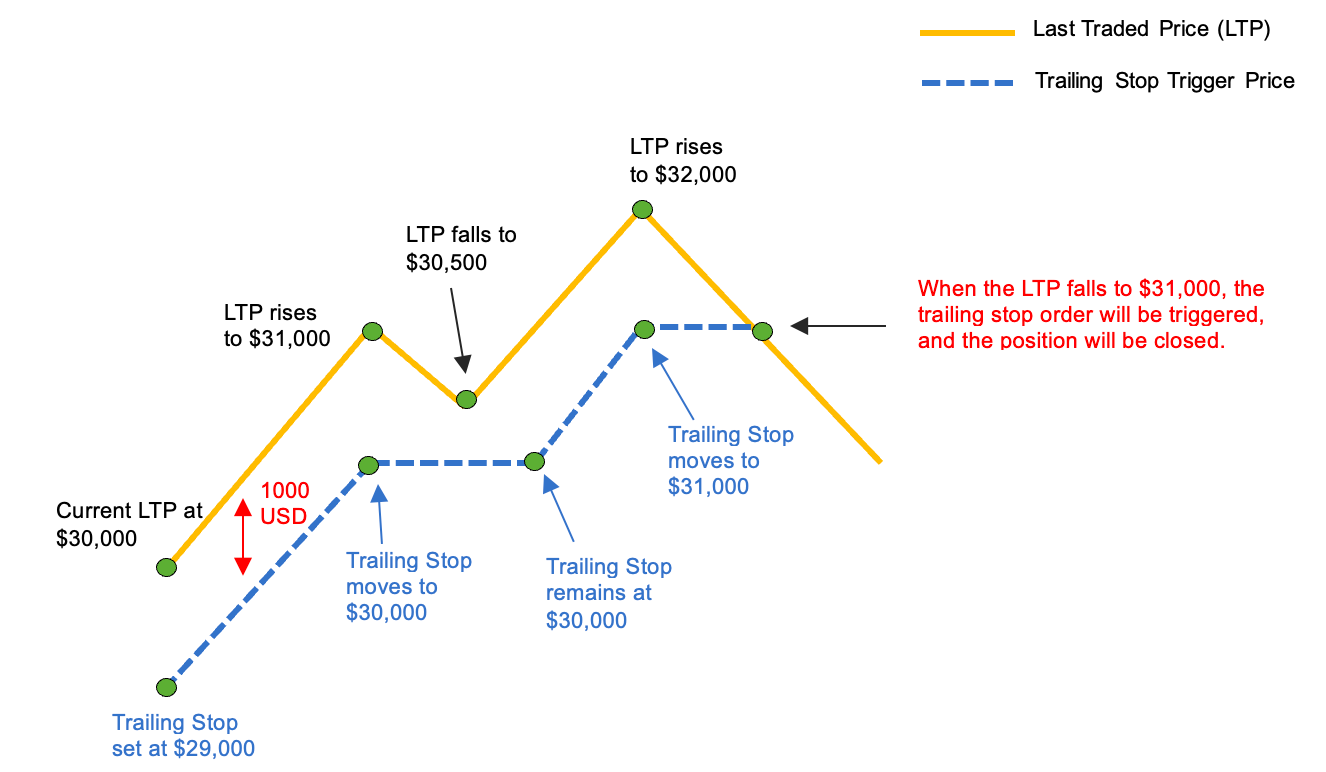

Example 1: Place a Trailing Stop order for a long position by a retracement distance

Suppose Trader A opens a long position of BTCUSD contracts at $30,000 and sets a Trailing Stop order with a retracement distance of $1,000.

The Trailing Stop function works as follows in the following scenarios:

- If the last traded price never exceeds $30,000, the Trailing Stop will be triggered at $29,000, similar to a normal stop loss.

- If the last traded price rises to $31,000, the Trailing Stop price will automatically adjust upwards by $1,000 (with retracement distance adjustments allowed at every $0.5), and the Trailing Stop will be triggered at $30,000.

- If the last traded price falls to $30,500, the Trailing Stop will remain at $30,000.

- A Trailing Stop order will only trigger in the event of a retracement of $1,000 from the highest price reached.

- If an activation price is set, the Trailing Stop order will be activated only after the activation price is reached. If no activation price is set, the Trailing Stop order will be activated immediately based on the current LTP after the order is placed.

Note: If you hold a long position, your Trailing Stop order will be a Market Sell order, and the activation price must be set higher than the average entry price of the position or the current last traded price.

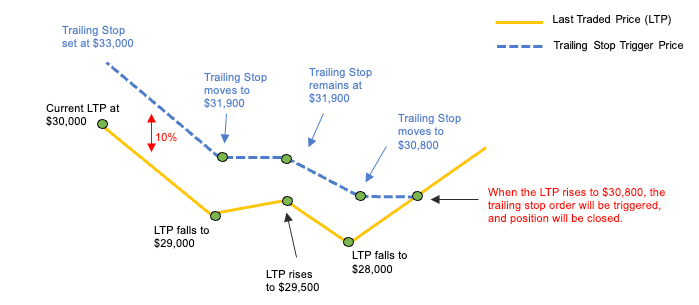

Example 2: Place a Trailing Stop order for a short position by a retracement rate

Suppose Trader B opens a short position of BTCUSD contracts at $31,000 and sets a Trailing Stop order with a retracement rate of 10%.

The Trailing Stop function works as follows in the following scenarios:

- If the last traded price never falls below $30,000, the Trailing Stop order will be triggered at $33,000, which is similar to a normal stop loss.

- If the last traded price falls to $29,000, the Trailing Stop price will automatically adjust downwards by 10% (with retracement rate adjustments allowed at every 0.1%), and the Trailing Stop order will be triggered at $31,900.

- If the last traded price rises to $29,500, the Trailing Stop order will remain at $31,900.

- A Trailing Stop order will only trigger in the event of a retracement of 10% from the lowest price reached.

- If the activation price is set, the Trailing Stop order will be activated only after the activation price is reached. If no activation price is set, the Trailing Stop order will be activated immediately based on the current LTP after the order is placed.

Note: If you hold a short position, your Trailing Stop order will be a Market Buy order, and the activation price must be set lower than the average entry price of the position or the current last traded price.

Therefore, with the above examples, we can derive that the trigger price of a Trailing Stop order for Perpetual and Futures Trading is as follows:

Trailing Stop for Long Position: Highest price - Retracement Distance or Highest price x (1 - Retracement Percentage)

Trailing Stop for Short Position: Lowest price + Retracement Distance or Lowest price x (1 + Retracement Percentage)

Trailing Profit

By utilizing the activation price feature on the Trailing Stop in Perpetual and Futures trading, it also allows you to activate the Trailing Stop only when the position is in profit, known as Trailing Profit.

Example

Let's assume Trader B holds a long position in BTCUSDT contracts, and the last traded price is 28,000 USDT. The trader wants to place a Trailing Stop with a distance of 500 USDT when the last traded price reaches 30,000 USDT.

The trader can set a Trailing Stop with 500 USDT of retracement distance and an activation price of 30,000 USDT. When the last traded price reaches 30,000 USDT, the Trailing Stop order will be placed, with a trigger price of 29,500 USDT (30,000 USDT - 500 USDT).

How to Place a Trailing Stop Order on Perpetual and Futures Trading

Here’s a step-by-step guide on how to place a Trailing Stop Order on Perpetual and Futures Trading.

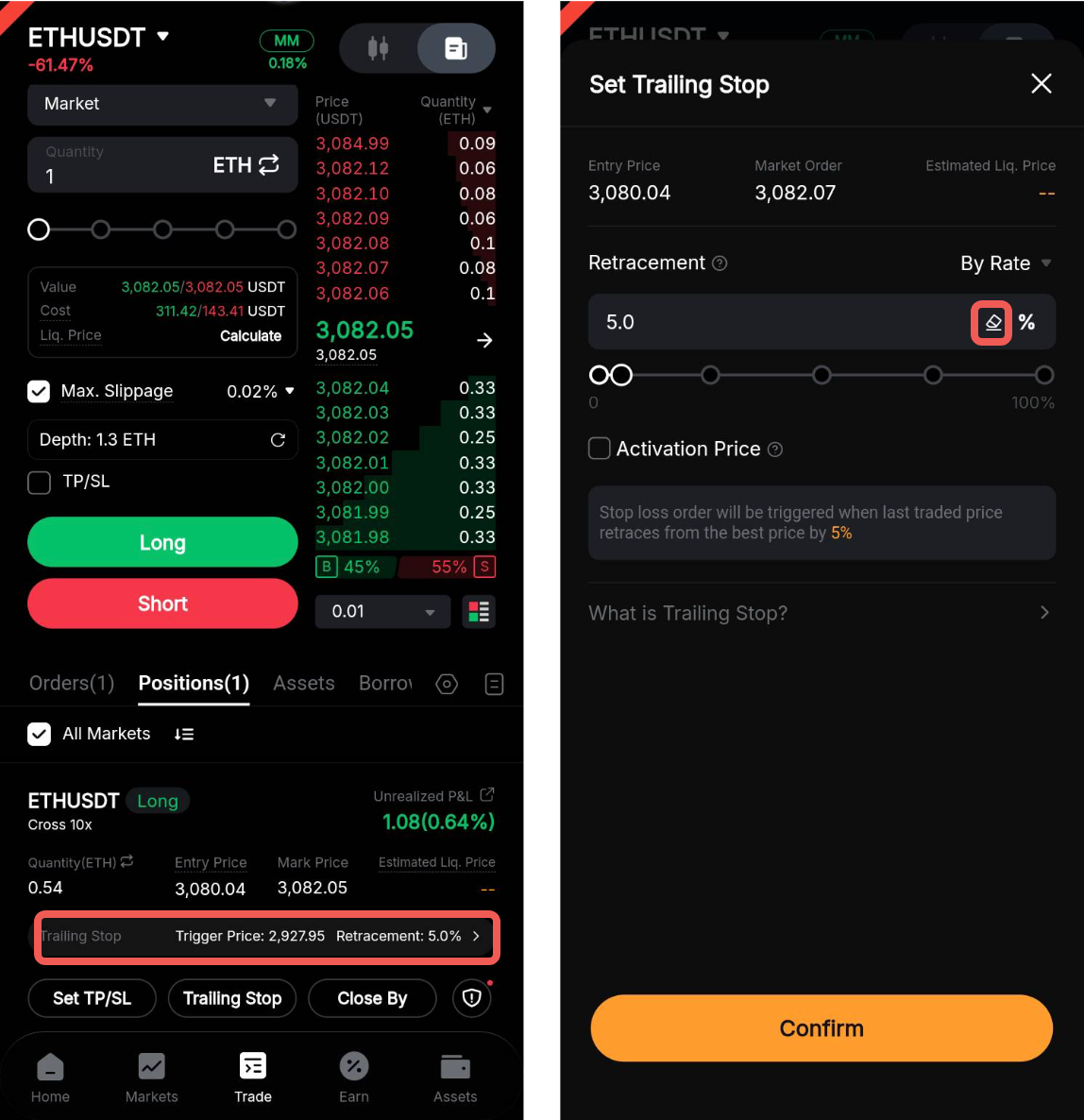

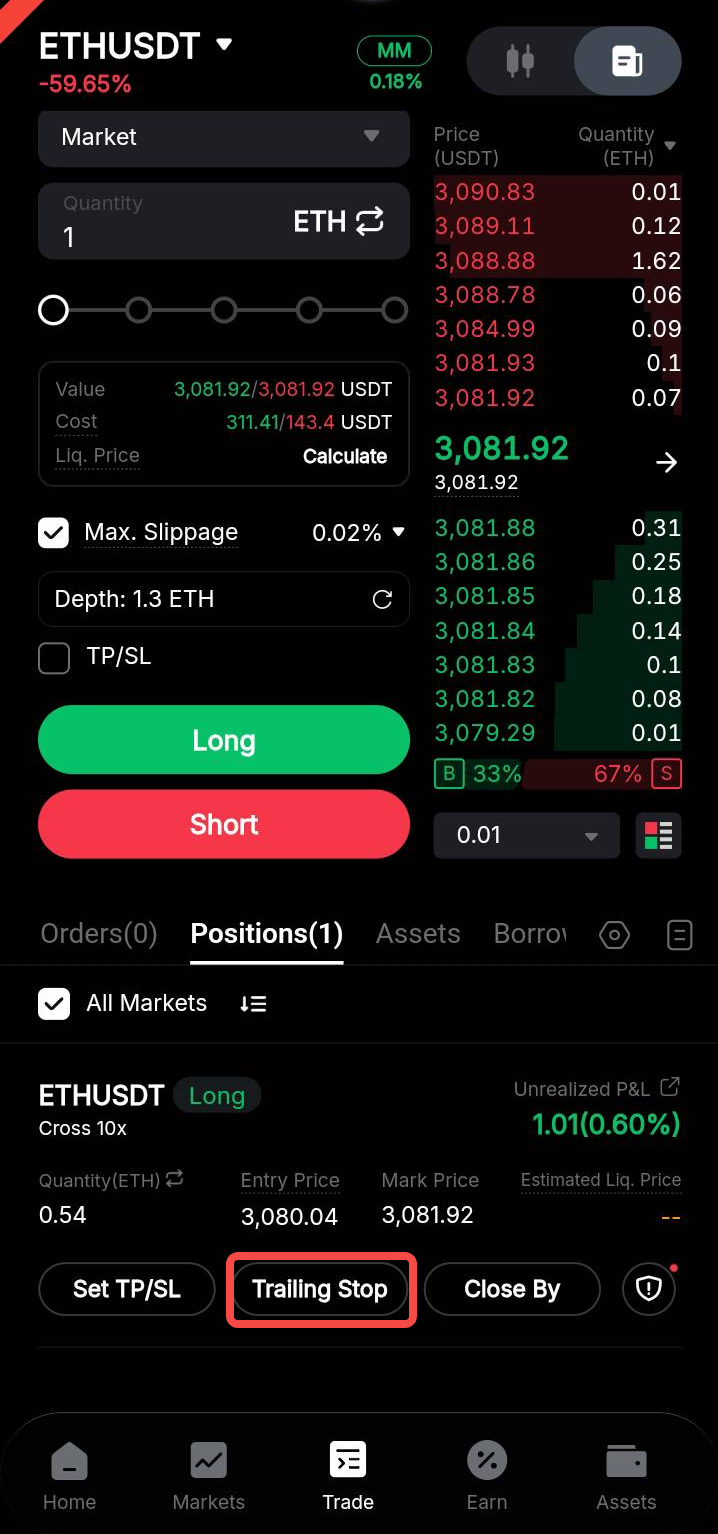

Step 1: Navigate to your opened position on the Perpetual and Futures trading page, and tap on the Trailing Stop.

Step 2: Select your Retracement trigger method (by Rate or Distance) and set an Activation Price if needed. Then, tap on Confirm.

You have successfully placed your Trailing Stop order!

You can view the Trailing Stop order details associated with your position. Tap on the Trailing Stop details if you want to modify order parameters.

To cancel your Trailing Stop order, tap on the eraser icon next to your retracement, and then tap on Confirm.