Kami meningkatkan pengalaman pinjaman UTA dengan menghadirkan fitur Peminjaman Manual baru, yang dirancang untuk memberi Anda kontrol dan fleksibilitas yang lebih besar saat berdagang dengan margin. Fitur ini diperkirakan akan diluncurkan pada tanggal 15 Oktober 2025 (waktu peluncuran dapat bervariasi). Di bawah ini, kami menggarisbawahi perubahan penting yang perlu Anda ketahui.

Liabilitas

Sebelum peningkatan, semua liabilitas dalam Akun Perdagangan Terpadu diperlakukan sebagai saldo gabungan tunggal. Setelah peningkatan, mereka akan dipisah menjadi liabilitas Spot dan liabilitas Derivatif. Perbedaan ini memengaruhi penanganan pelunasan.

Liabilitas Spot

Termasuk jumlah pinjaman dari Perdagangan Margin Spot atau Pinjaman Manual, ditambah bunga yang masih harus dibayar.

Liabilitas Derivatif

Termasuk jumlah pinjaman dari perdagangan Derivatif, seperti:

- L&R terealisasi dan belum terealisasi dari kontrak Perpetual & Expiry

- Biaya perdagangan dan biaya pendanaan

- Bunga dari pinjaman Derivatif

- Penurunan nilai Opsi

- Premi opsi

Ikhtisar: Pinjaman UTA dalam Perdagangan Margin Spot

Fitur | Sebelum Peningkatan | Setelah Peningkatan |

Pinjaman Manual | Tidak didukung | Didukung |

Pinjaman Otomatis (Perdagangan Margin Spot) | Didukung | Didukung |

Pelunasan Koin Tunggal | Hanya pelunasan penuh (koin pinjaman ATAU konversi penuh) yang didukung.

Pembayaran sebagian/campuran tidak tersedia. | Pelunasan penuh, sebagian, dan campuran (koin pinjaman + konversi) didukung. |

Lunasi Semua | Didukung. Sistem hanya mengonversi aset jaminan untuk pelunasan. | Didukung. Sistem menggunakan koin pinjaman yang tersedia terlebih dahulu, kemudian aset jaminan. |

Perbarui | Tidak Didukung | Hanya untuk Pinjaman dengan Tarif Tetap Jika pelunasan dilakukan sebelum tanggal jatuh tempo, Anda dapat mengajukan perpanjangan dan melanjutkan pinjaman hingga tanggal jatuh tempo akhir. |

Pelunasan Otomatis Melalui Transfer Masuk (ke UTA) | Dapat digunakan untuk membayar kembali liabilitas Spot dan Derivatif. | Hanya dapat digunakan untuk membayar liabilitas Derivatif. |

Pelunasan Otomatis oleh Perdagangan Spot | Dapat digunakan untuk membayar kembali liabilitas Spot dan Derivatif. | Hanya dapat digunakan untuk membayar liabilitas Derivatif. |

Jenis Liabilitas | Tidak ada perbedaan antara liabilitas Spot dan Derivatif. | Liabilitas spot: Hanya pelunasan secara manual yang didukung.

Liabilitas derivatif: Pelunasan manual dan otomatis didukung. |

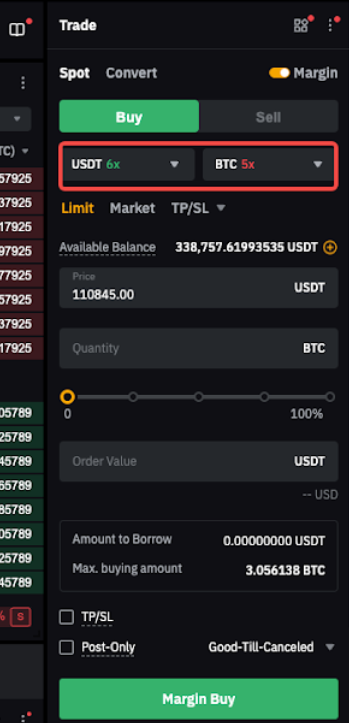

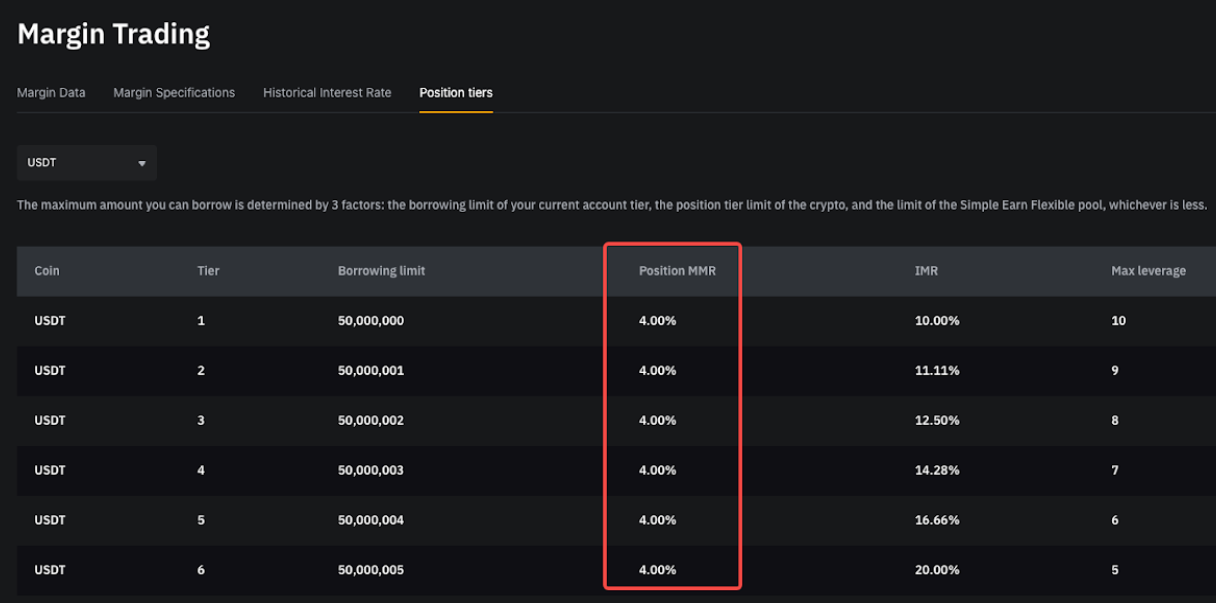

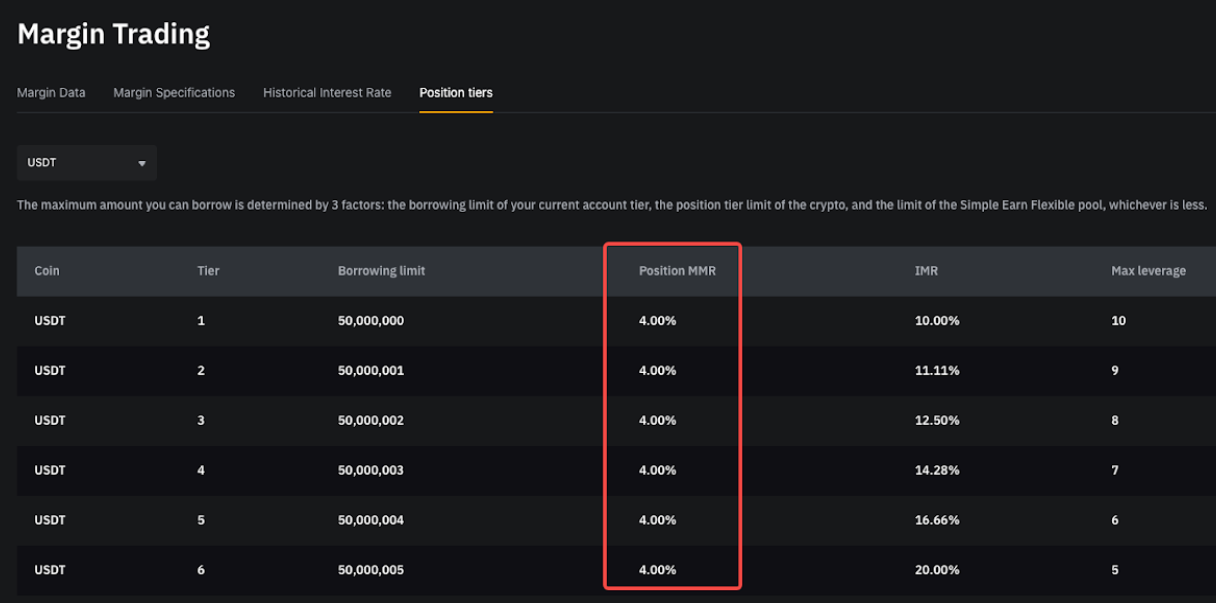

Leverage Maksimum (Margin Spot) | 10x untuk semua koin | Bervariasi berdasarkan koin |

Tingkat Margin Pemeliharaan (MMR) | Ditetapkan pada 4% | MMR bertingkat berdasarkan jumlah koin dan pinjaman.

Untuk detail selengkapnya, silakan lihat tingkatan posisi di sini. |

Perincian Perubahan Fitur

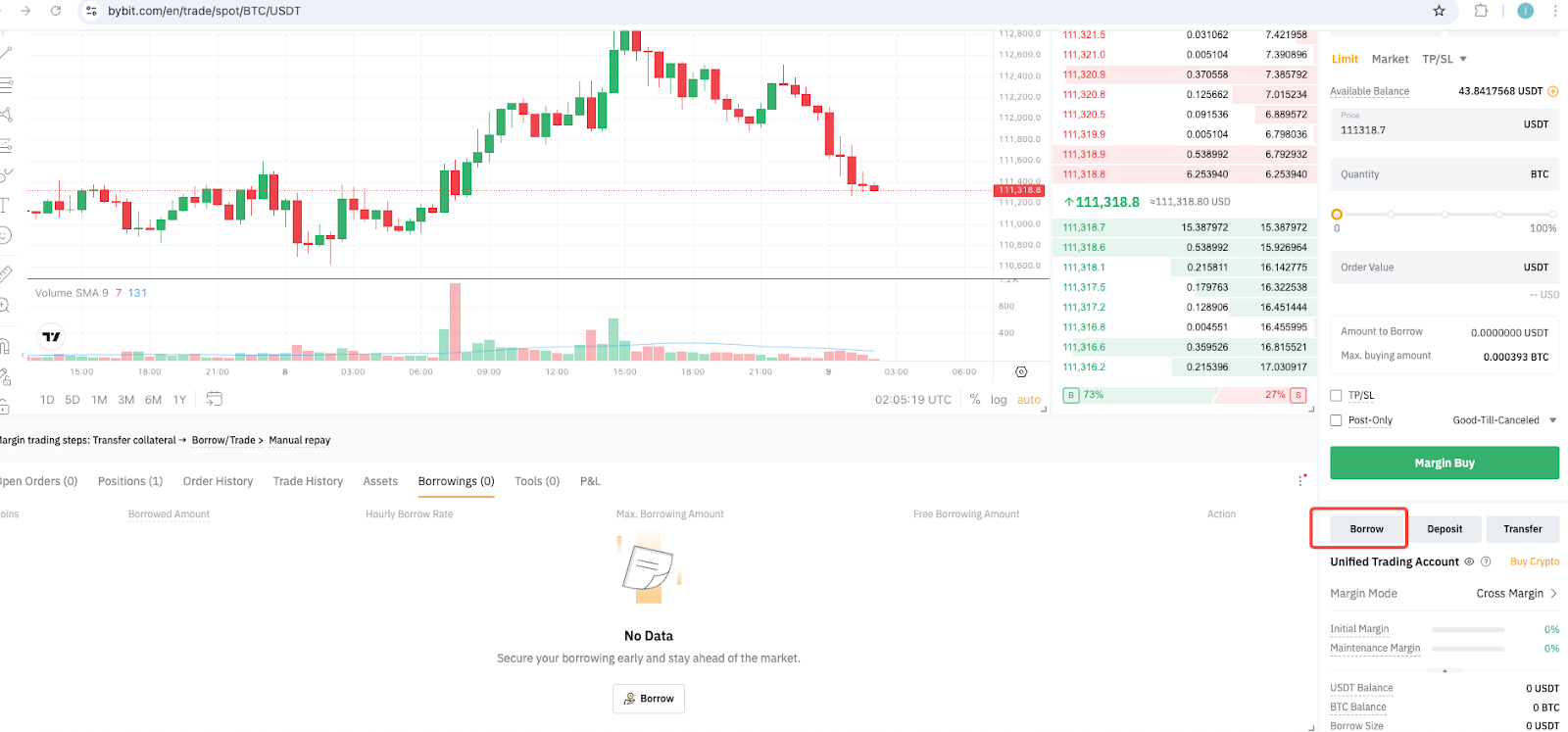

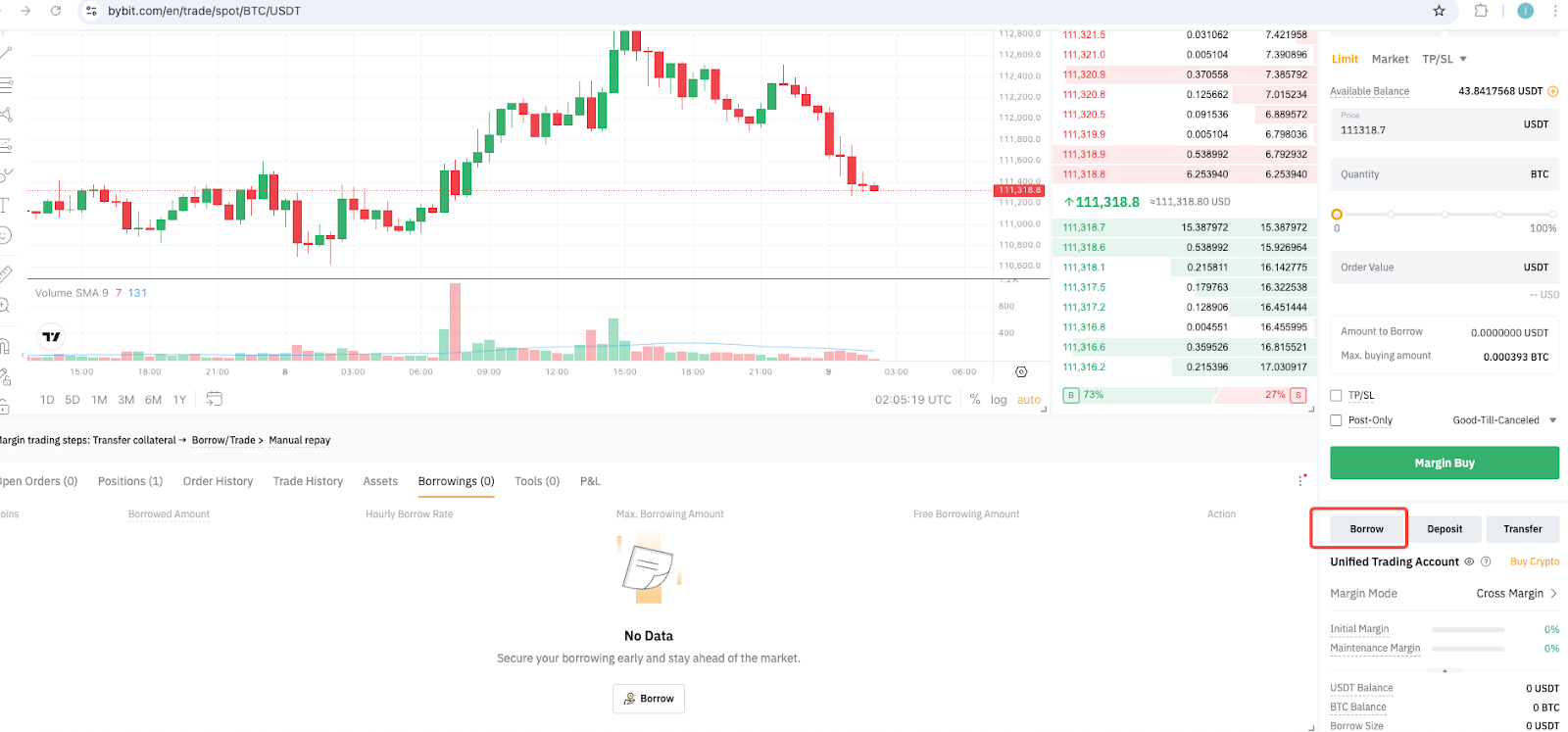

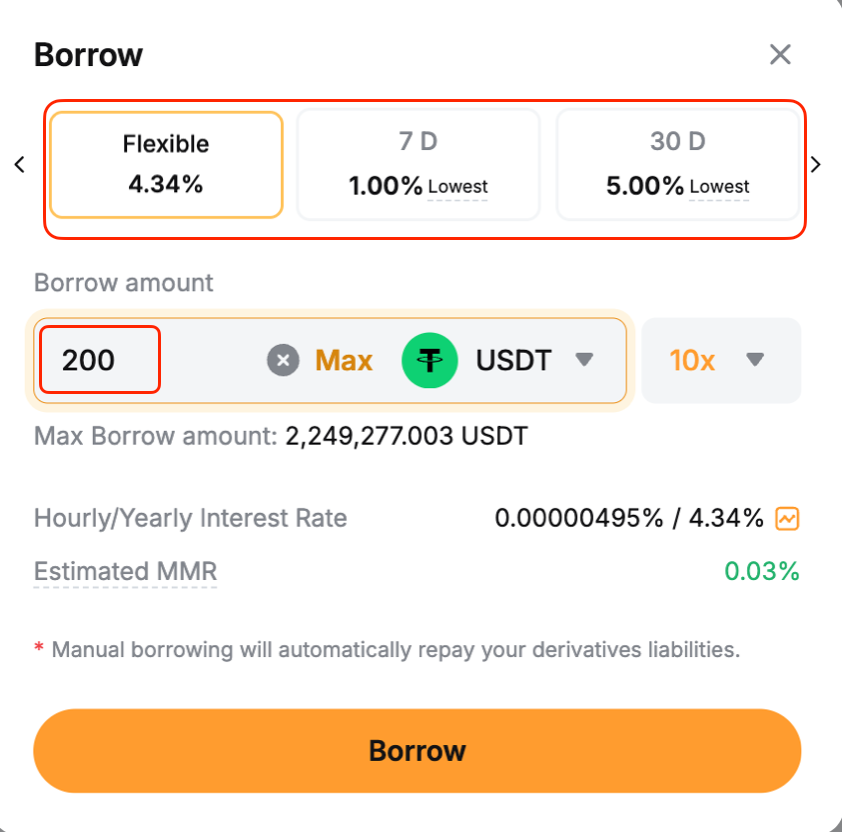

Perdagangan Margin Spot — Pinjaman Manual

Sebelum Peningkatan | Setelah Peningkatan |

Tidak didukung | Didukung pada halaman Margin Spot atau halaman Aset.

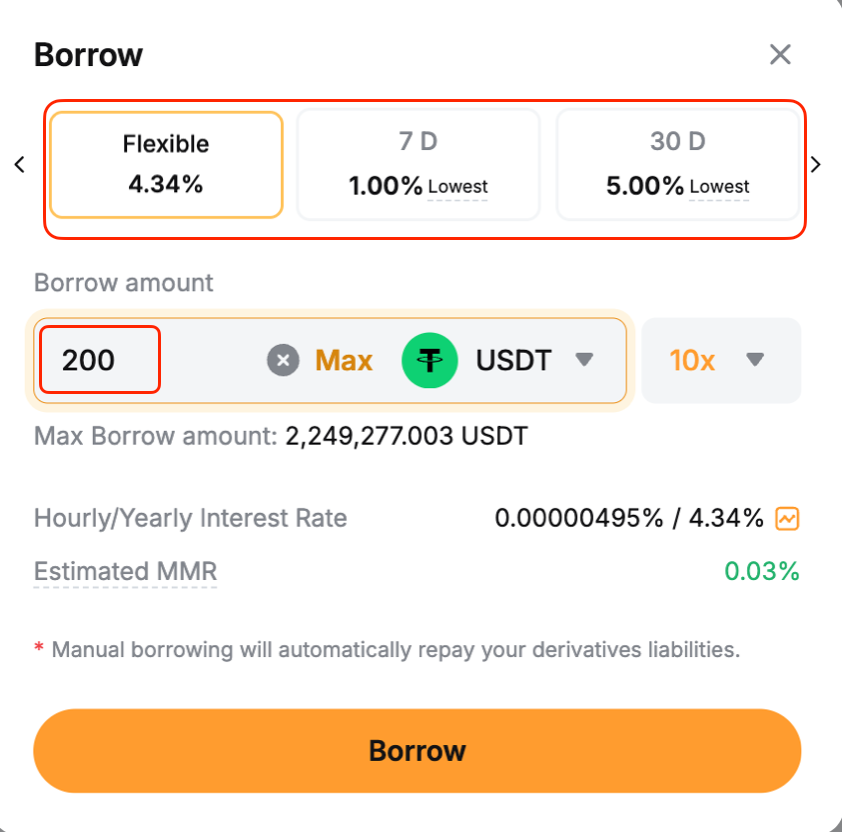

Untuk melakukan peminjaman manual: Langkah 1: Klik Pinjam.

Langkah 2: Pilih jenis pinjaman (Fleksibel atau Tetap) dan masukkan jumlahnya. Klik Pinjam untuk mengonfirmasi.

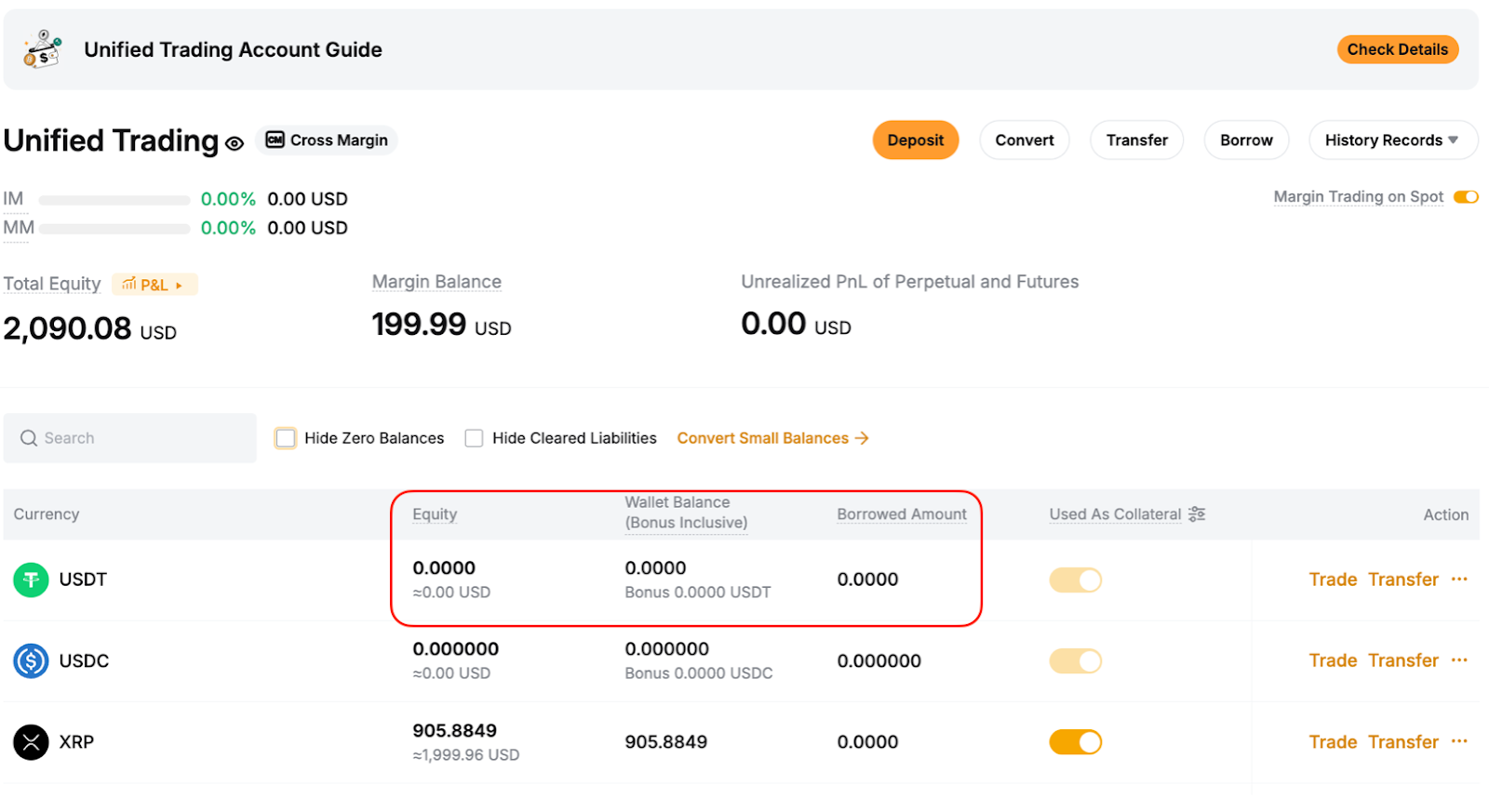

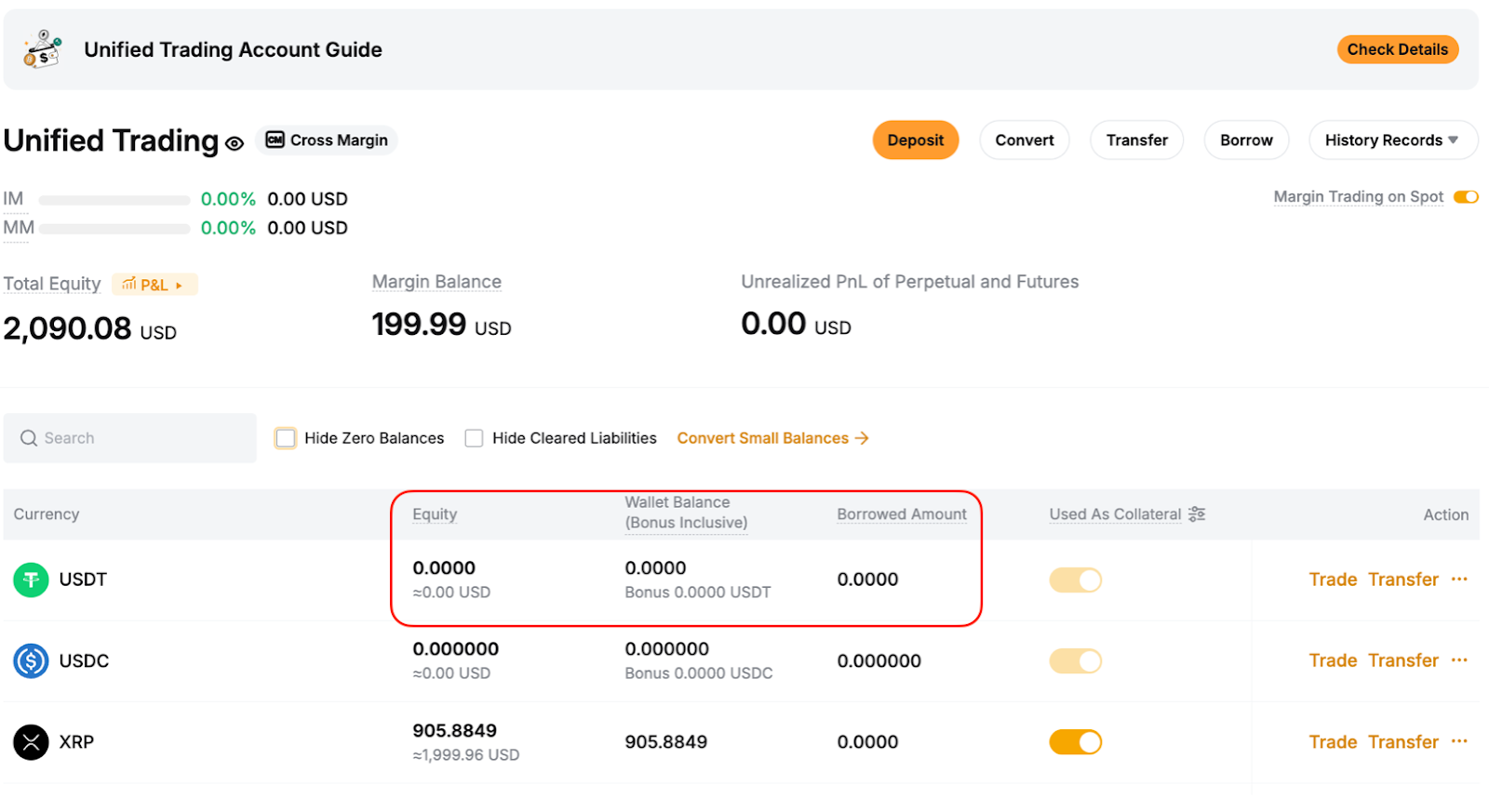

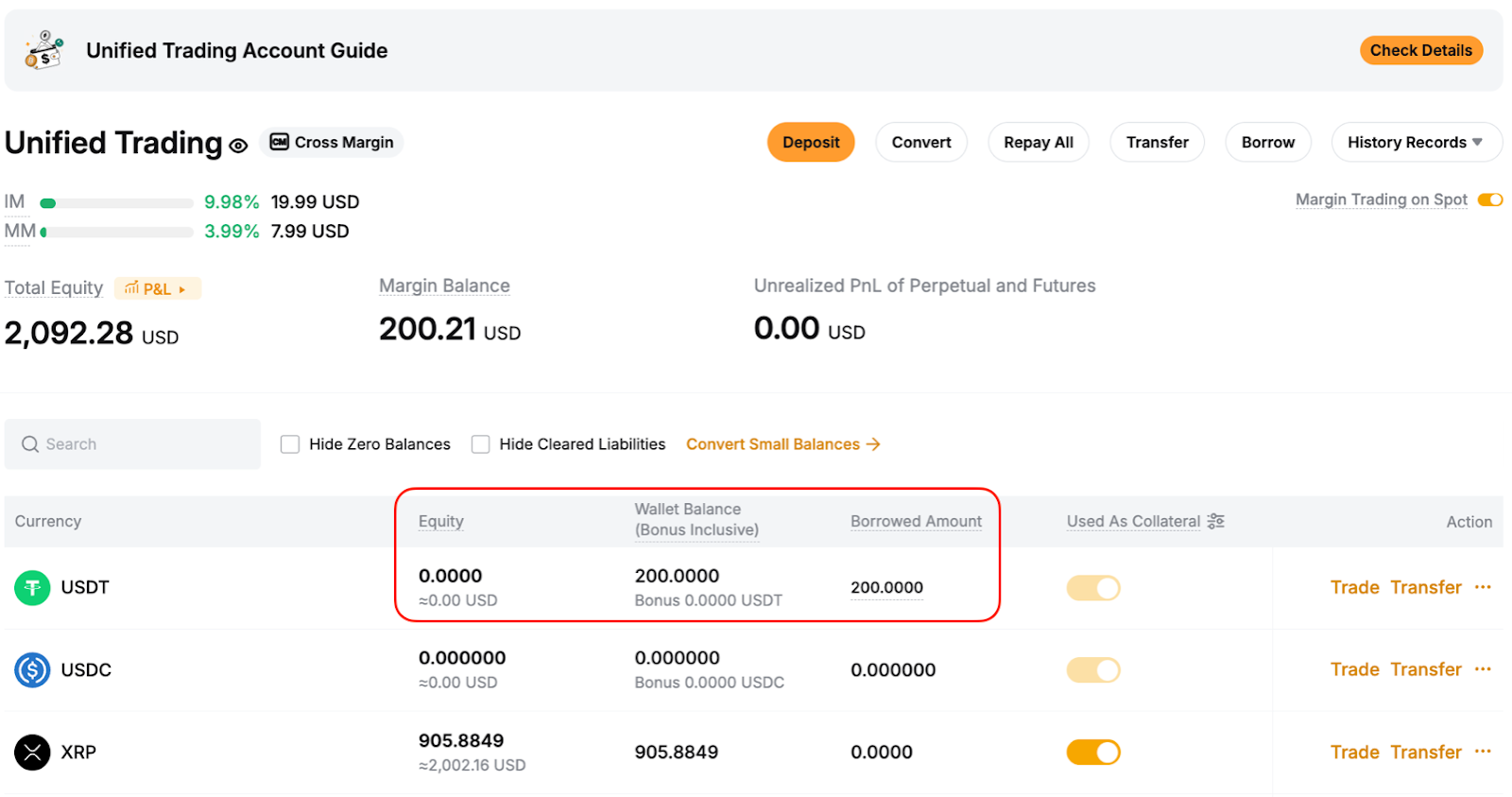

Contoh Sebelum meminjam: - Ekuitas USDT = 0

- Saldo dompet = 0

- Jumlah pinjaman = 0

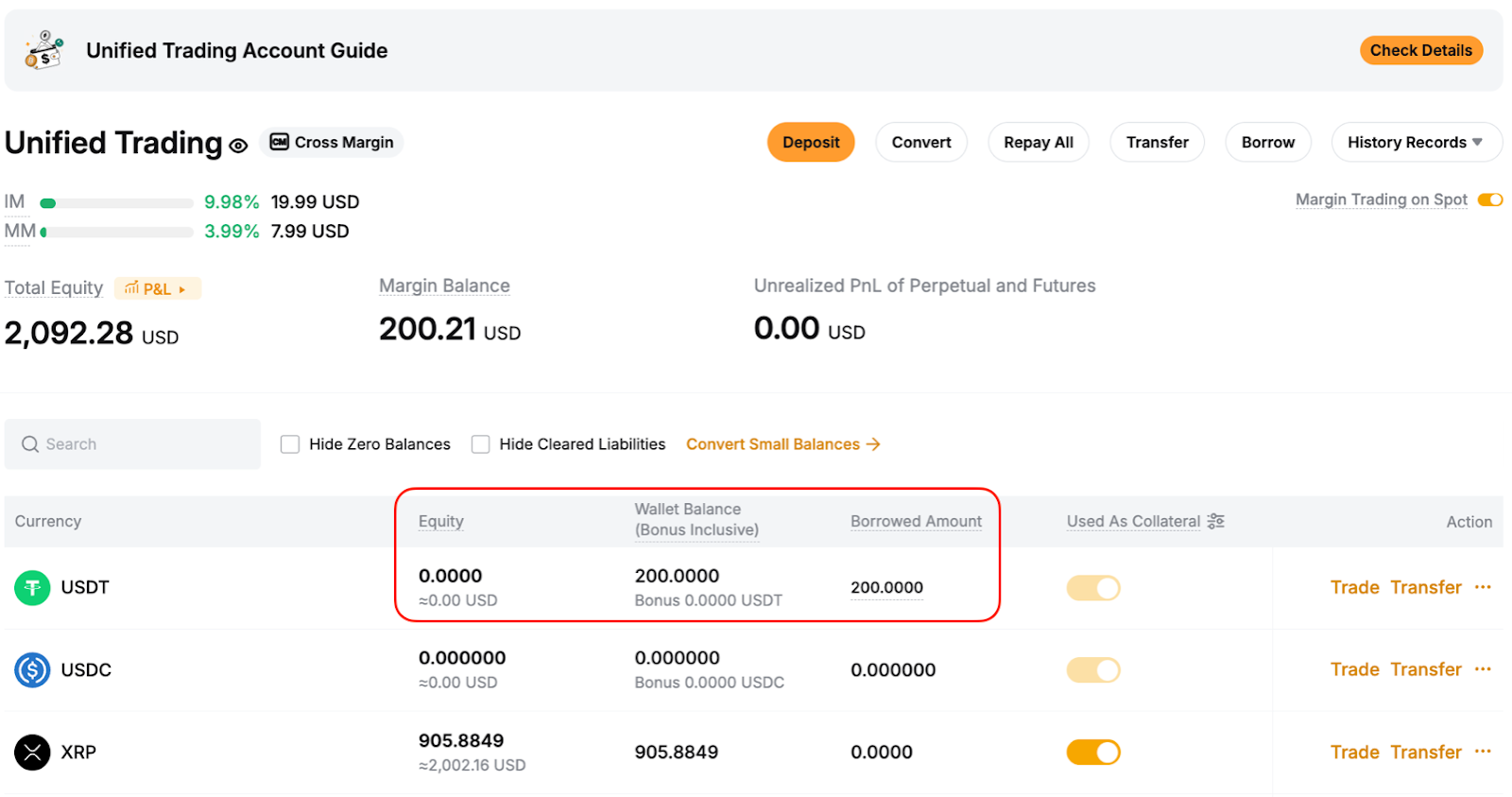

Setelah meminjam 200 USDT: - Ekuitas USDT = 0

- Saldo dompet USDT = 200

- Liabilitas spot (jumlah pinjaman) = 200

|

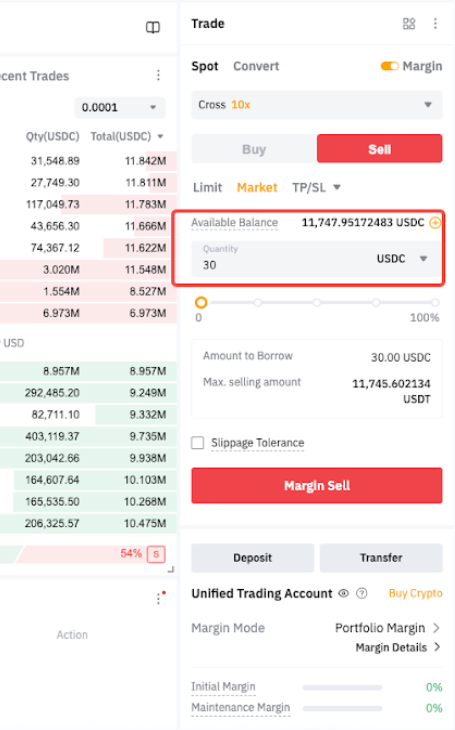

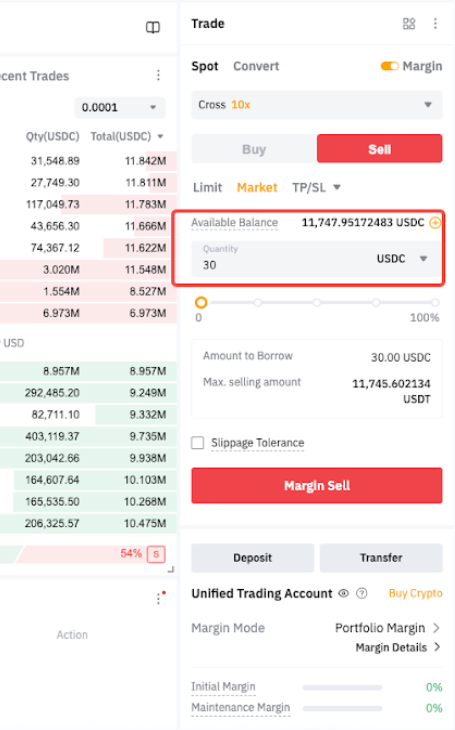

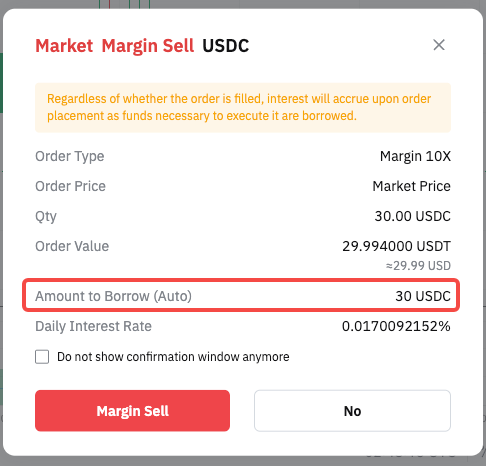

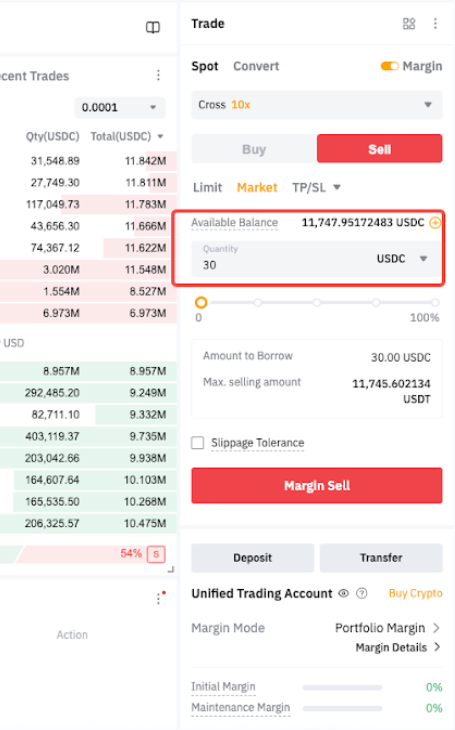

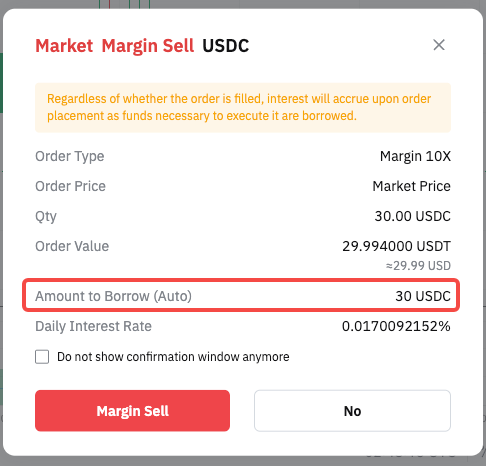

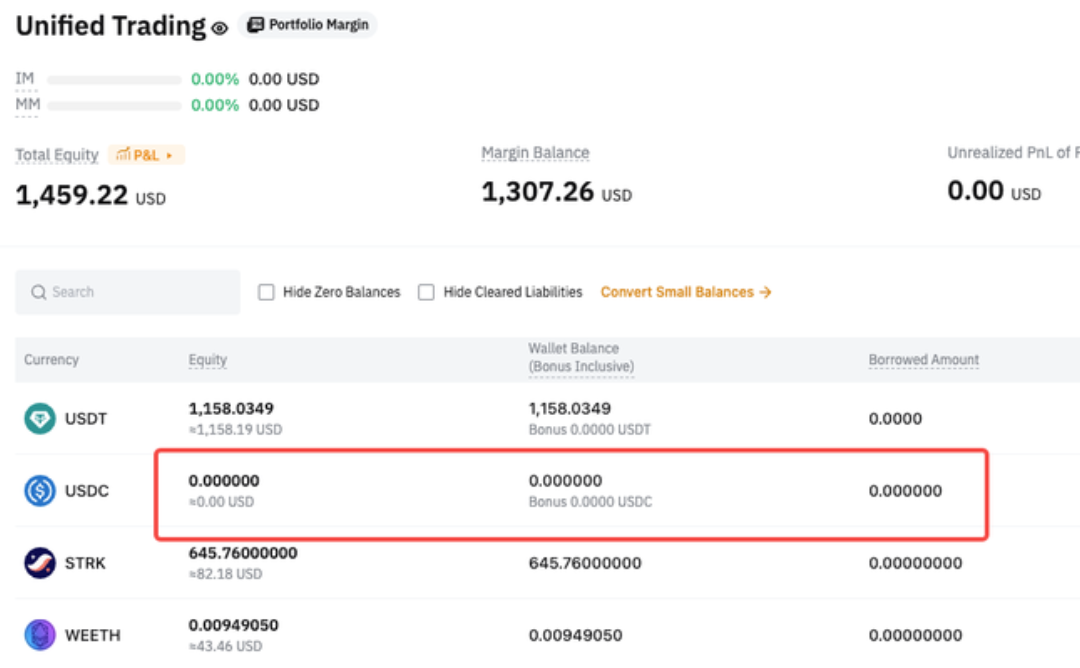

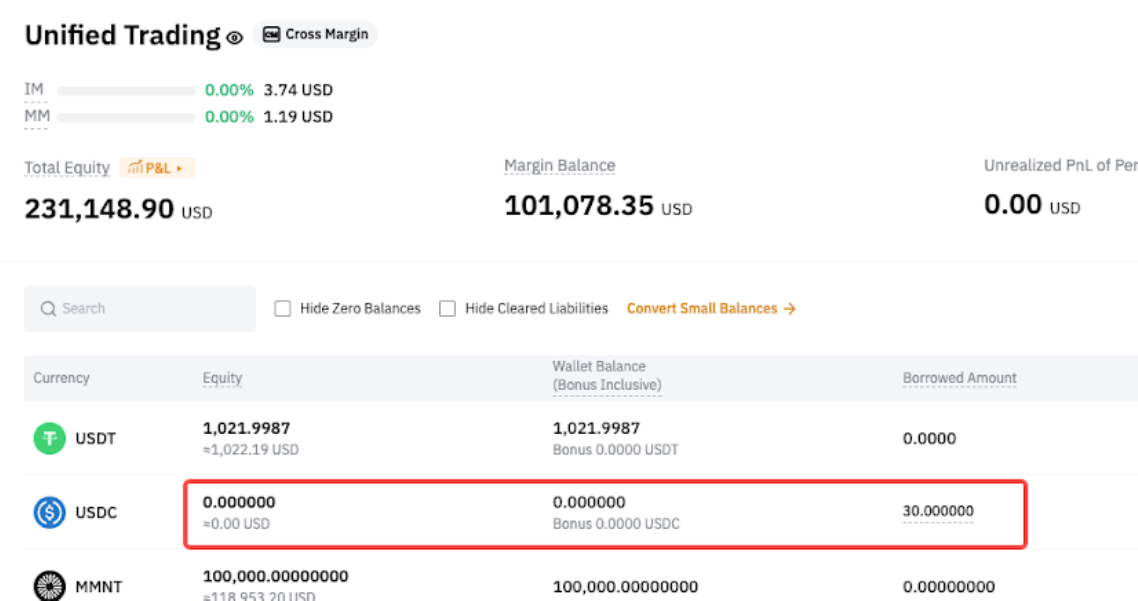

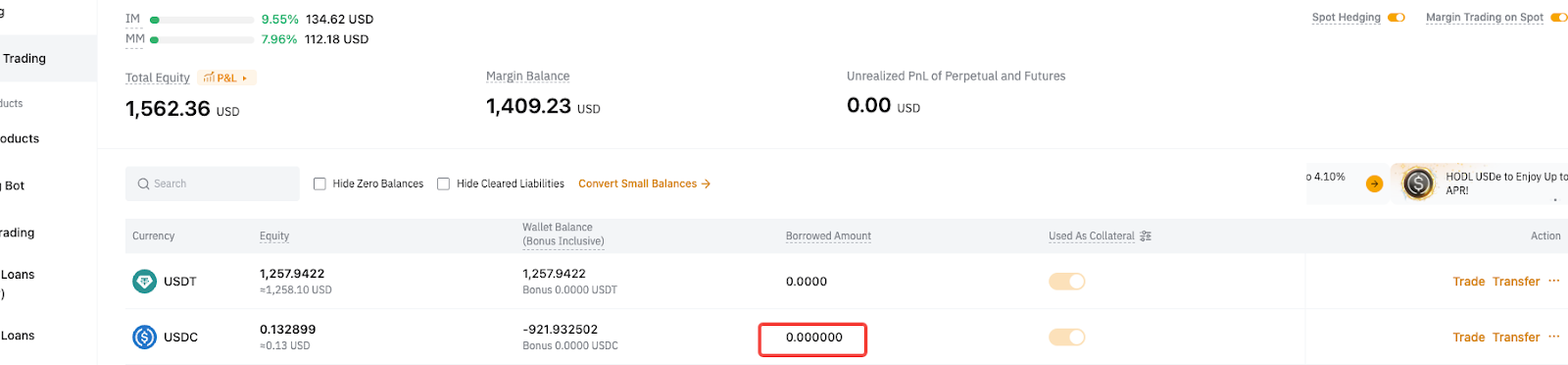

Perdagangan Margin Spot — Pinjaman Otomatis

Sebelum Peningkatan | Setelah Peningkatan |

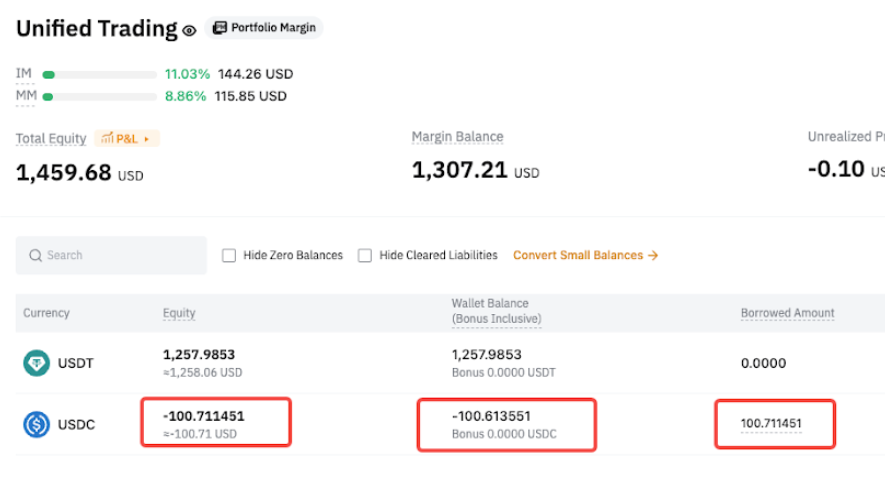

Didukung. Saldo dompet menunjukkan jumlah negatif, dan jumlah yang dipinjam dicatat.

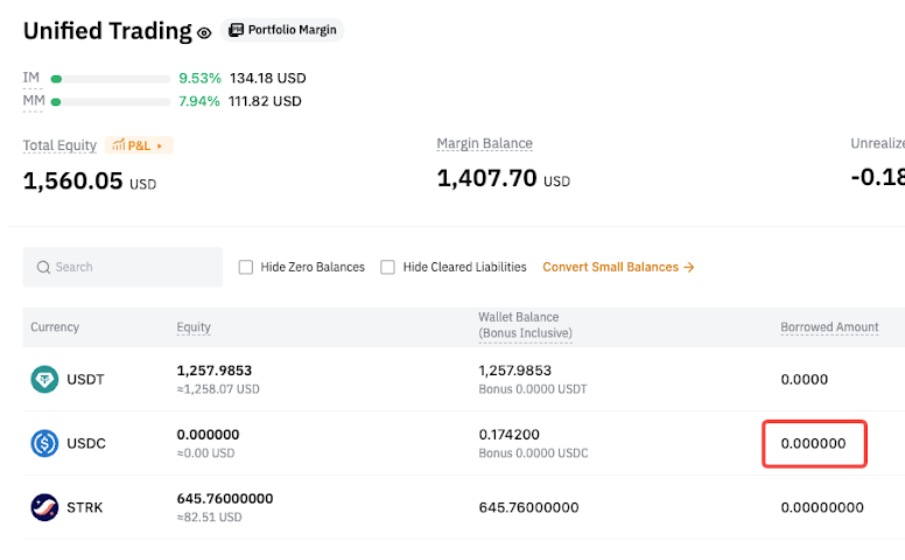

Contoh Anda menempatkan pesanan Margin Spot yang segera terisi. Sistem secara otomatis meminjam jumlah yang diperlukan. | Didukung. Saldo dompet menunjukkan nol, dan jumlah yang dipinjam dicatat.

Contoh Anda menempatkan pesanan Margin Spot yang segera terisi. Sistem secara otomatis meminjam jumlah yang diperlukan. |

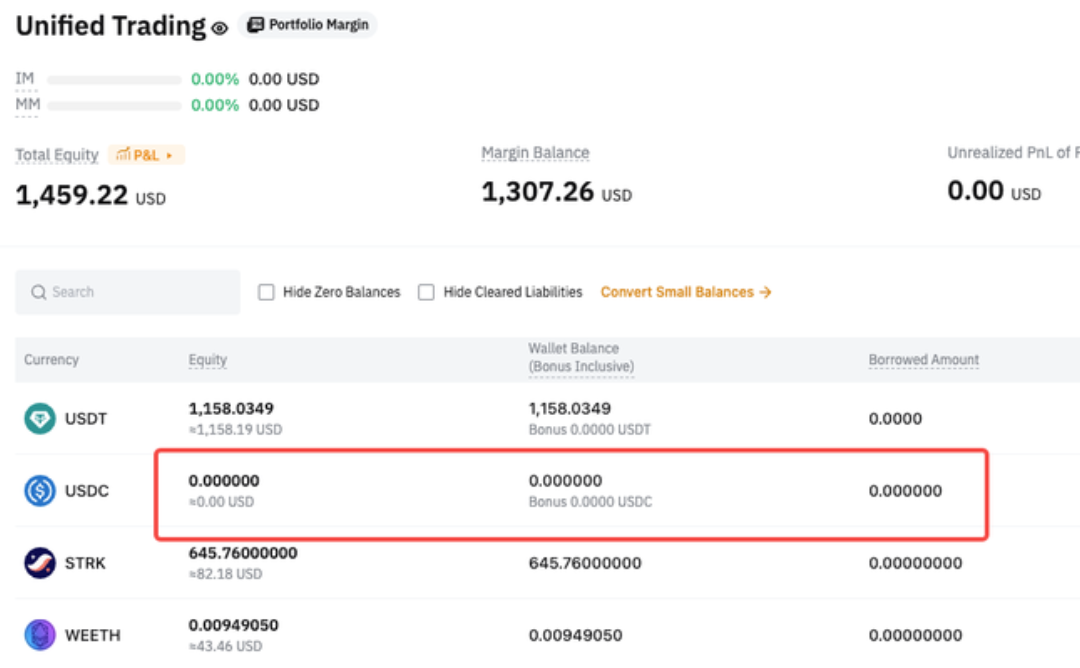

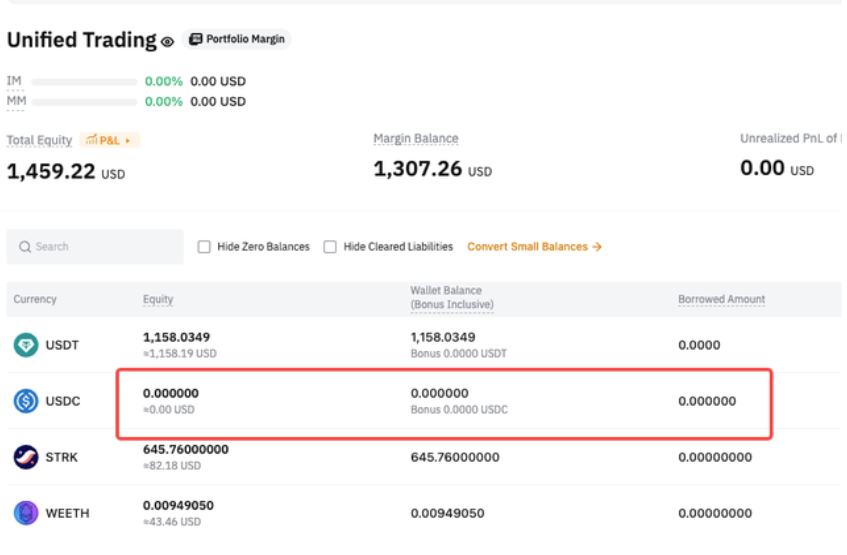

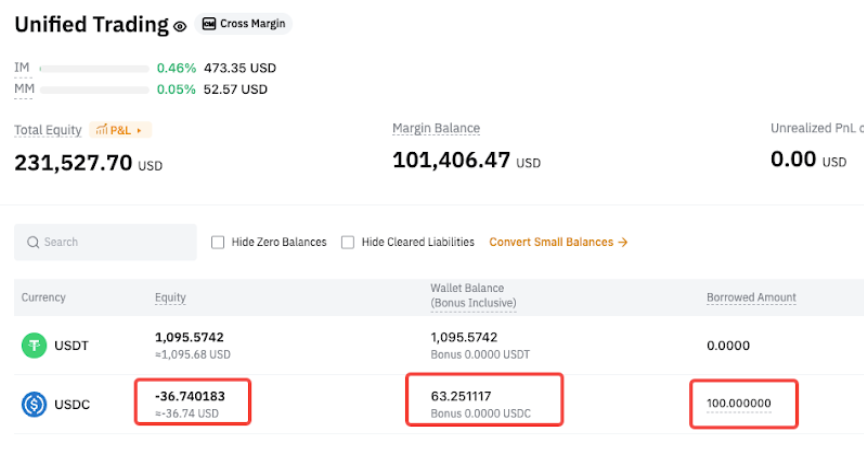

Sebelum meminjam: - Ekuitas USDC = 0

- Saldo dompet USDC = 0

- Jumlah pinjaman USDC = 0

Setelah meminjam: - Ekuitas USDC = -30

- Saldo dompet USDC = -30

- Jumlah pinjaman USDC = 30

|

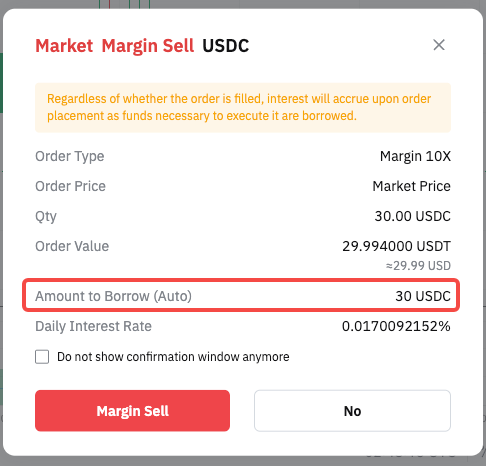

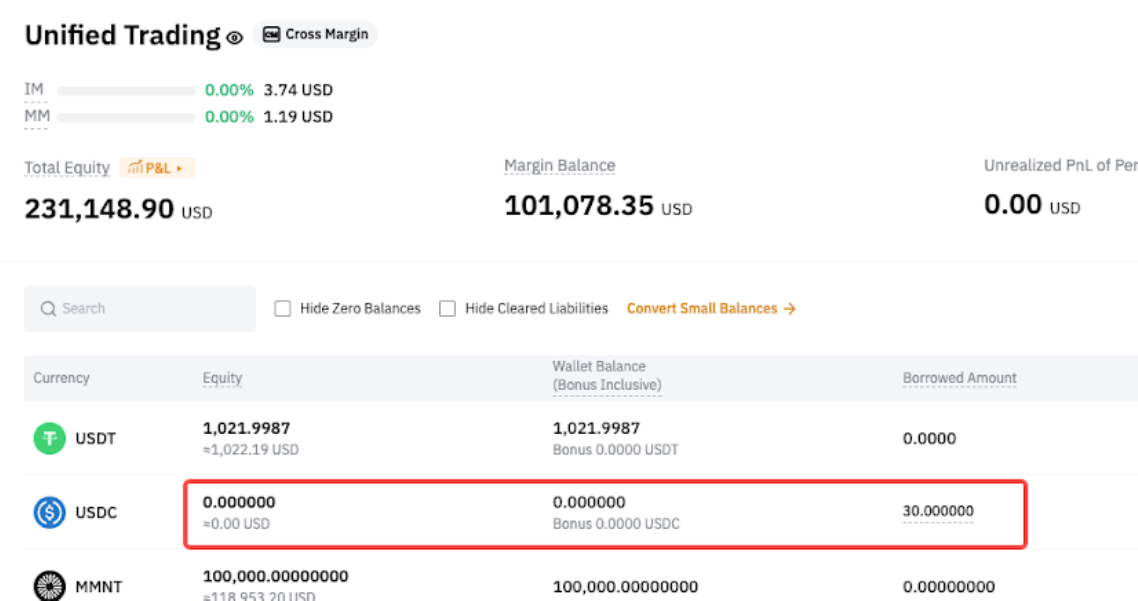

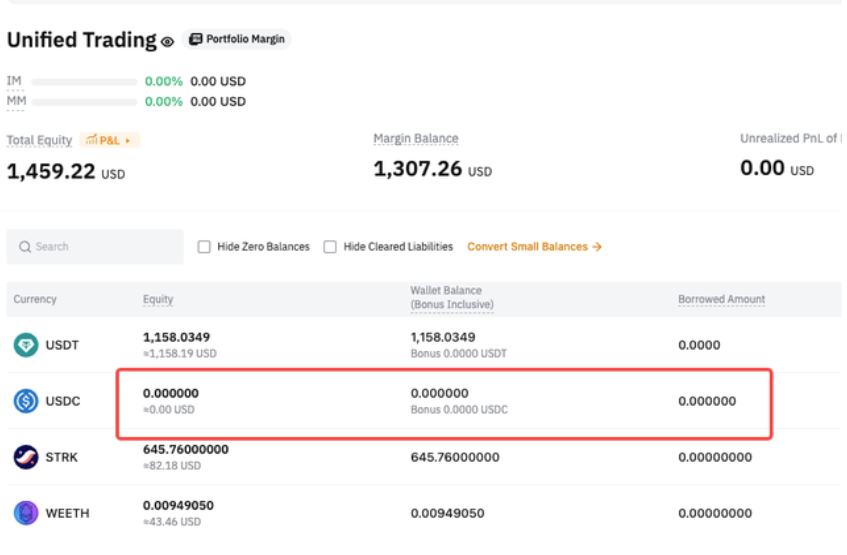

Sebelum meminjam: - Ekuitas USDC = 0

- Saldo dompet USDC = 0

- Jumlah pinjaman USDC = 0

Setelah meminjam: - Ekuitas USDC = -30

- Saldo dompet USDC = 0

- Jumlah pinjaman USDC = 30

|

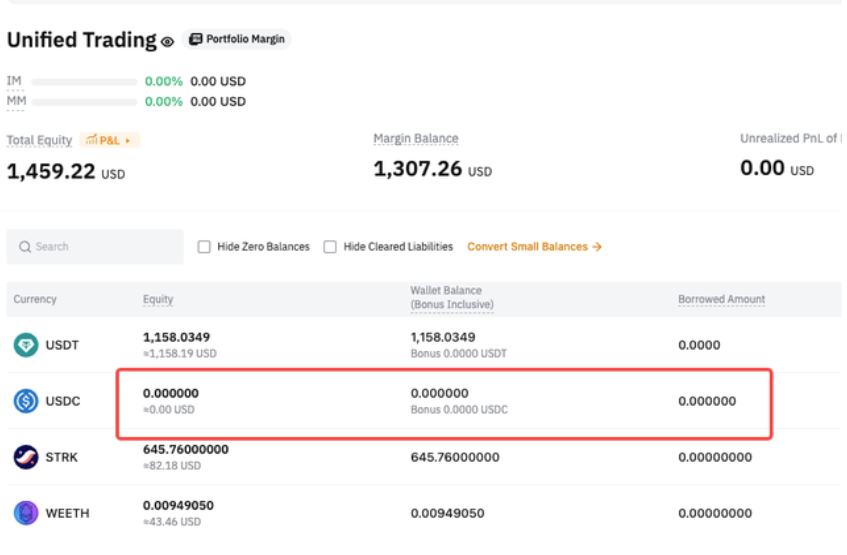

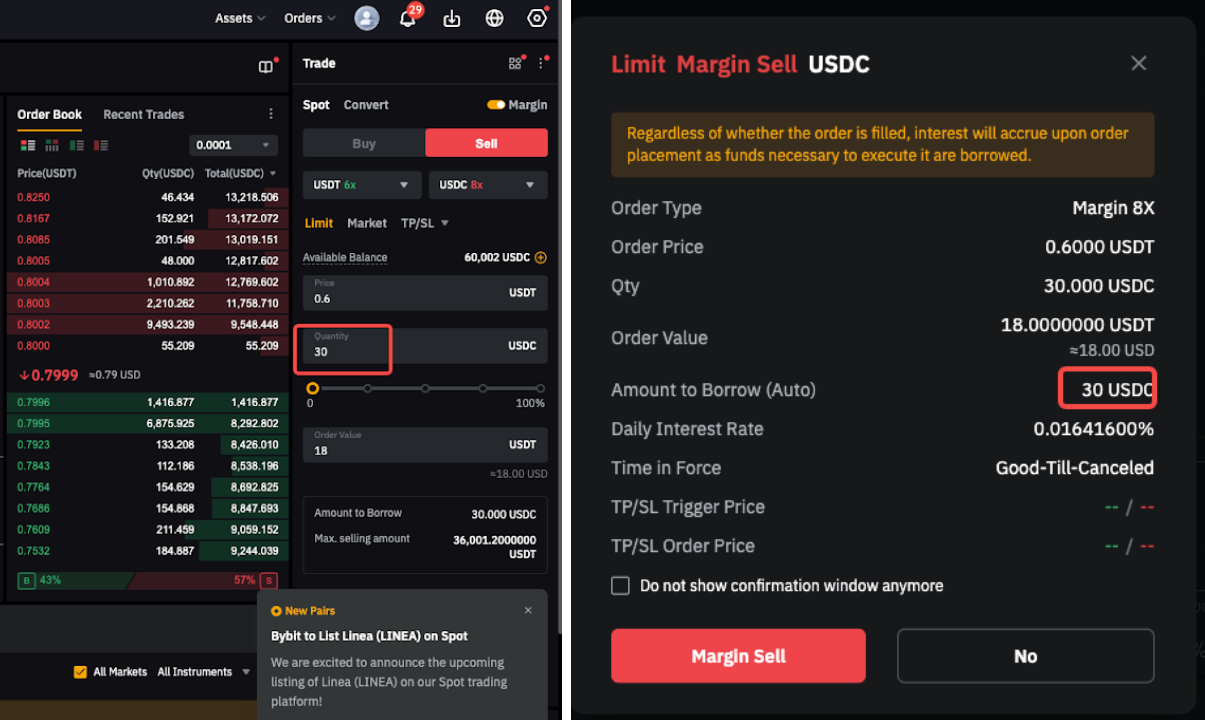

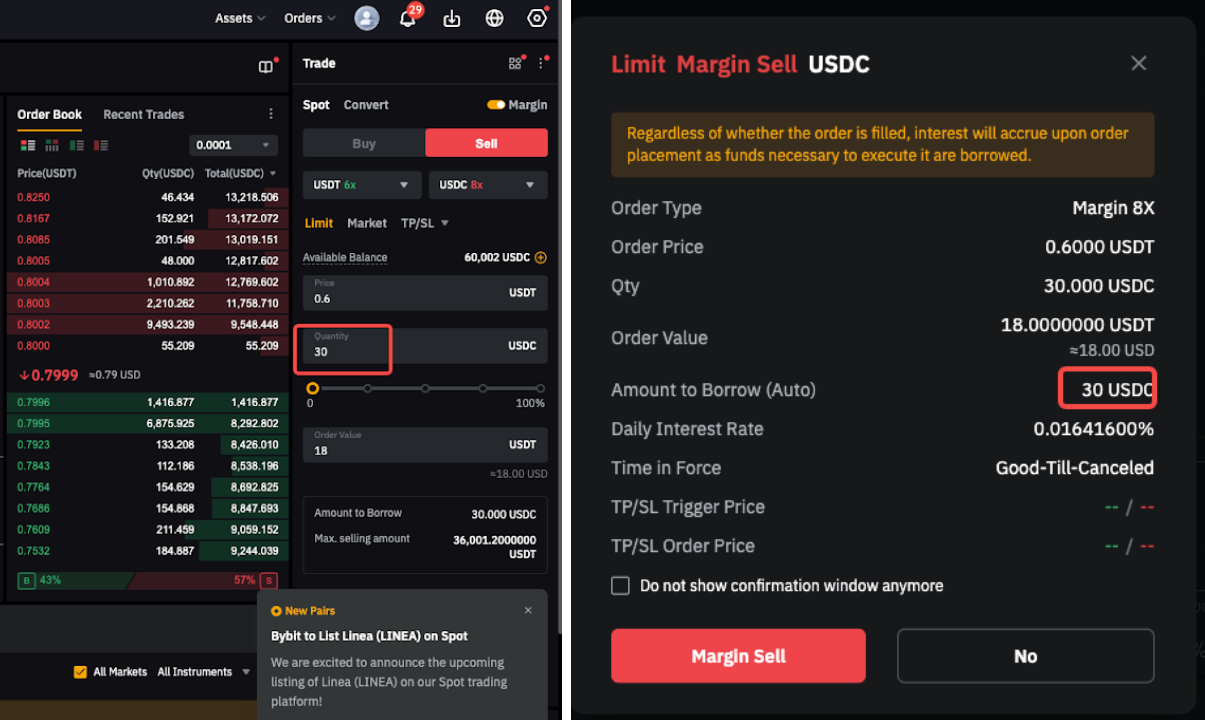

Perdagangan Margin Spot — Peminjaman Otomatis Pesanan Terbatas

Sebelum Peningkatan | Setelah Peningkatan |

Didukung | Tetap tidak berubah |

Contoh Anda menempatkan pesanan terbatas Margin Spot.

Sebelum meminjam: - Ekuitas USDC = 0

- Saldo dompet USDC = 0

- Jumlah pinjaman USDC = 0

Setelah meminjam: - Ekuitas USDC = 0

- Saldo dompet USDC = 0

- Jumlah pinjaman USDC = 30

|

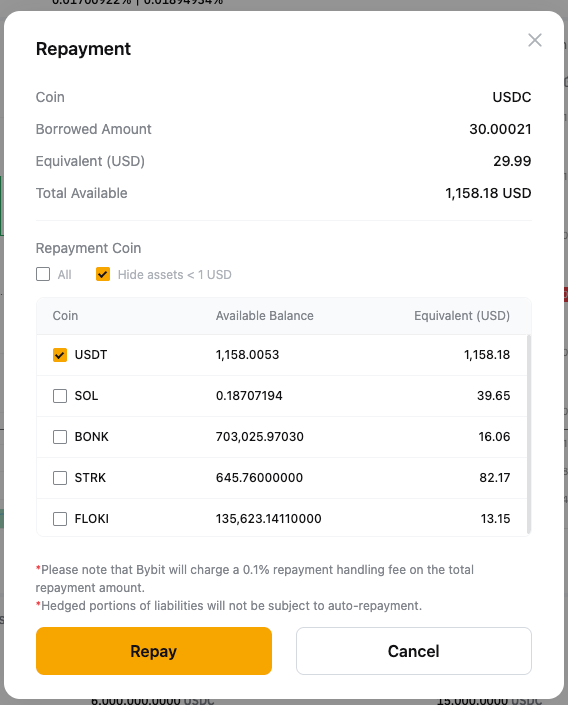

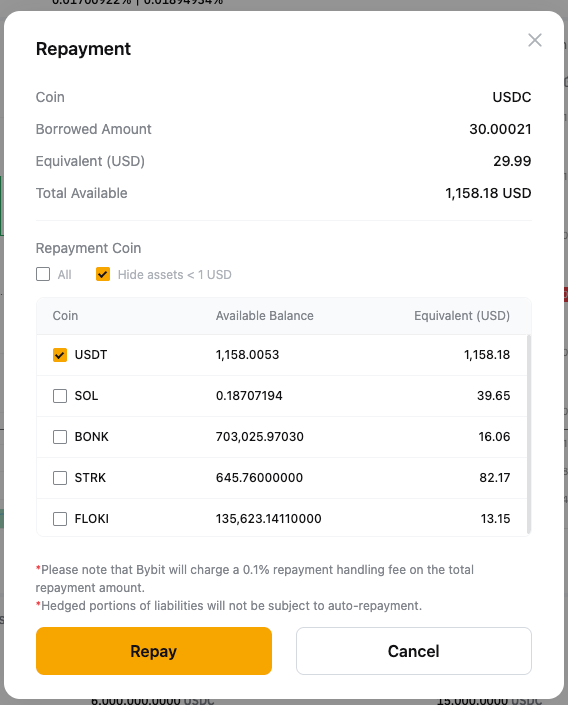

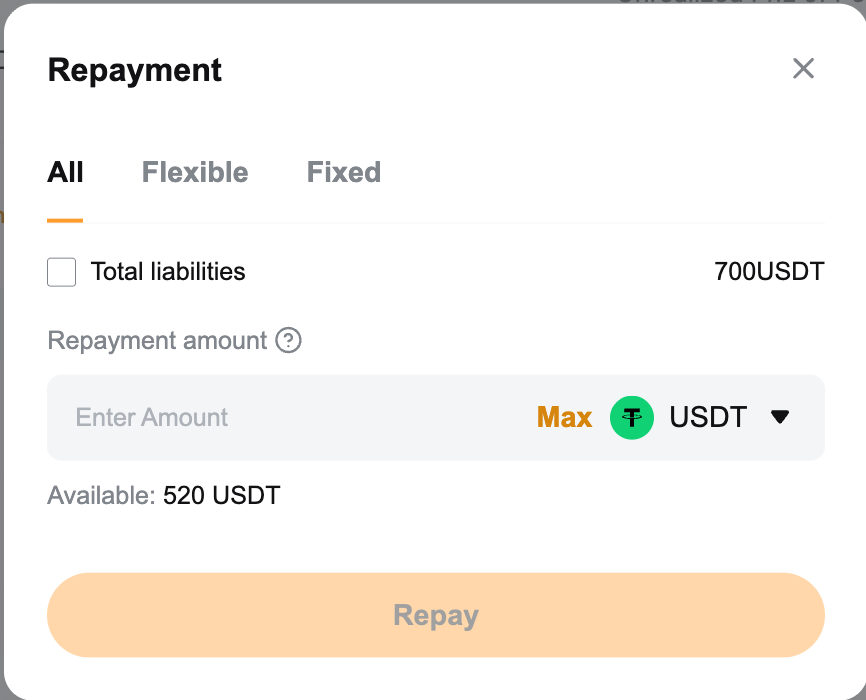

Pelunasan Koin Tunggal

Sebelum Peningkatan | Setelah Peningkatan |

- Hanya pelunasan penuh (menggunakan koin pinjaman atau konversi) yang didukung.

- Pelunasan sebagian atau campuran (koin pinjaman + konversi) tidak didukung.

| Pelunasan penuh dan sebagian (menggunakan koin pinjaman) didukung. |

Untuk melakukan pelunasan koin tunggal:

Langkah 1: Buka halaman Pelunasan Koin Tunggal. Hanya pelunasan penuh yang didukung.

Jika Anda tidak memiliki cukup koin pinjaman, Anda dapat melakukan pelunasan penuh dengan aset jaminan lainnya. Sistem akan mengonversi jaminan untuk melunasi koin yang dipinjam, dan biaya penanganan 0,1% akan berlaku. | Untuk melakukan pelunasan koin tunggal:

Langkah 1: Buka halaman Pelunasan Koin Tunggal. Pelunasan penuh dan sebagian didukung.

Sistem akan menggunakan koin pinjaman Anda yang tersedia untuk pelunasan. |

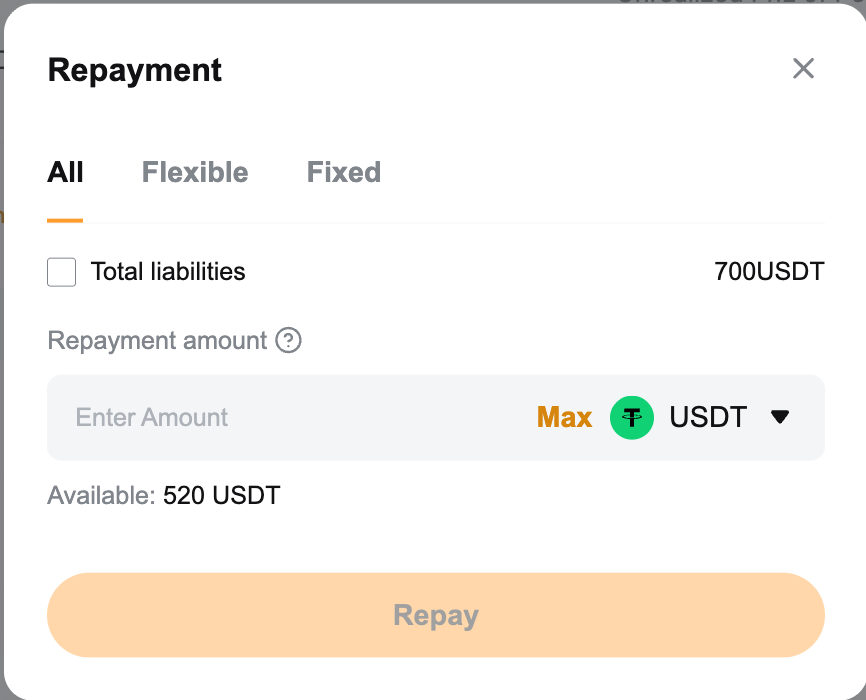

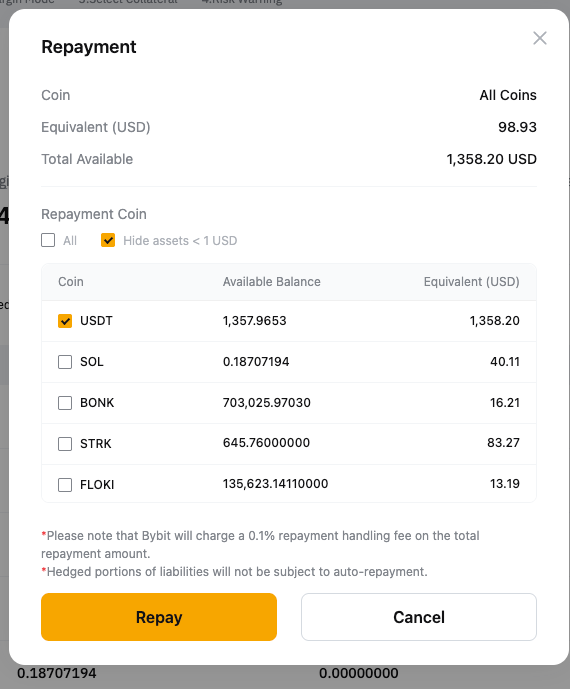

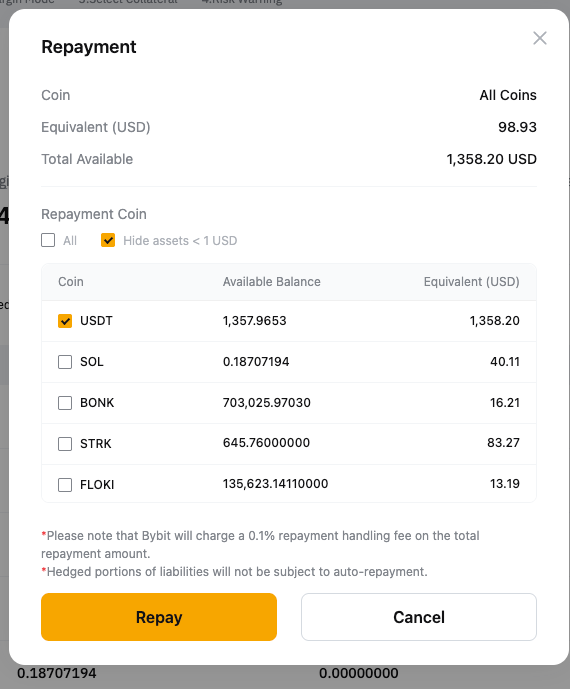

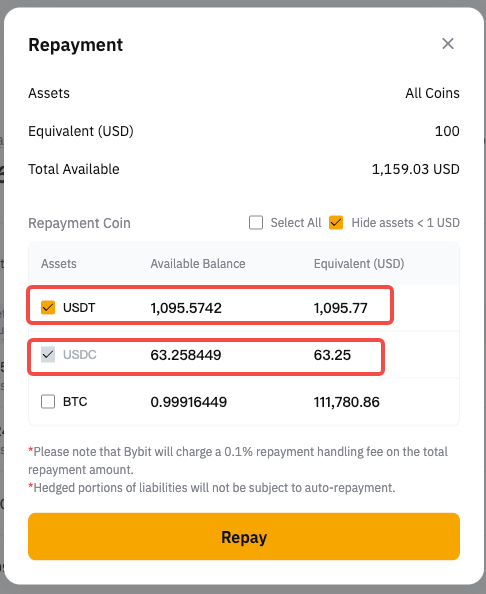

Lunasi Semua Liabilitas

Sebelum Peningkatan | Setelah Peningkatan |

Mengonversi jaminan untuk melunasi koin pinjaman. | Menggunakan koin pinjaman yang tersedia terlebih dahulu, kemudian mengonversi jaminan. |

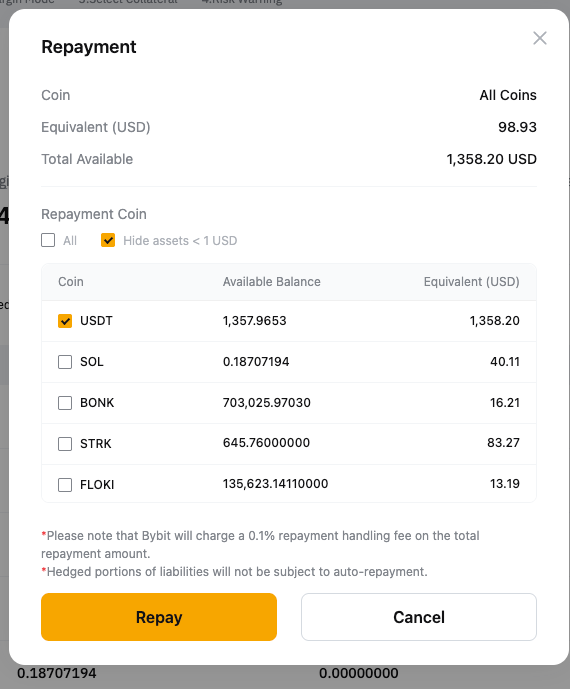

Langkah 1: Klik Lunasi Semua, lalu pilih koin jaminan untuk pelunasan.

Langkah 2: Sistem akan mengonversi jaminan yang dipilih menjadi koin yang dipinjam untuk melunasi liabilitas Anda.

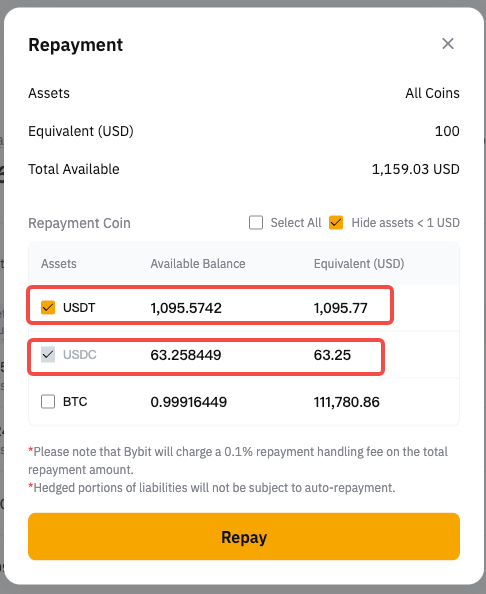

| Langkah 1: Klik Lunasi Semua, lalu pilih koin untuk pelunasan.

Langkah 2: Sistem akan terlebih dahulu menggunakan koin pinjaman Anda yang tersedia untuk pelunasan. Jumlah yang tersisa akan ditanggung dengan mengonversi jaminan Anda ke koin yang dipinjam.

|

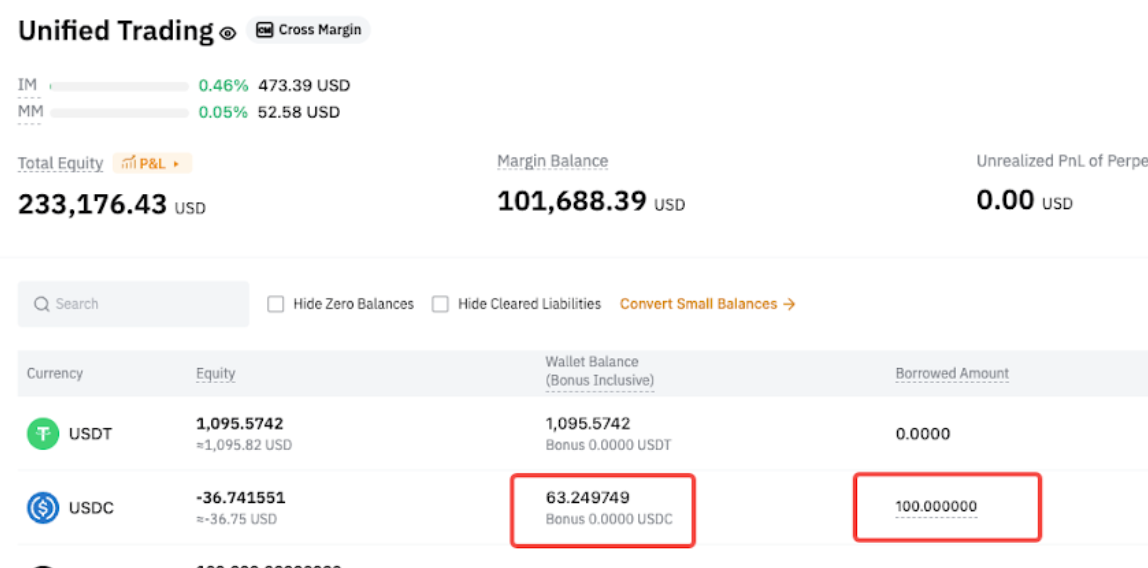

Pelunasan melalui Transfer Masuk

Sebelum Peningkatan | Setelah Peningkatan |

Koin transfer digunakan untuk membayar kembali liabilitas Spot dan Derivatif. | Koin transfer hanya digunakan untuk membayar kembali liabilitas Derivatif. Liabilitas spot tetap terutang dan harus dibayar secara manual. |

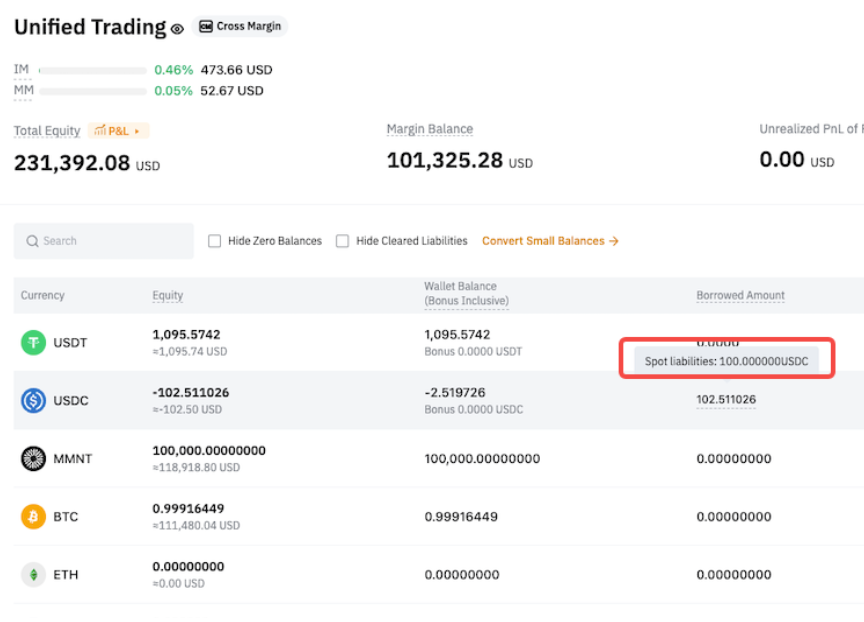

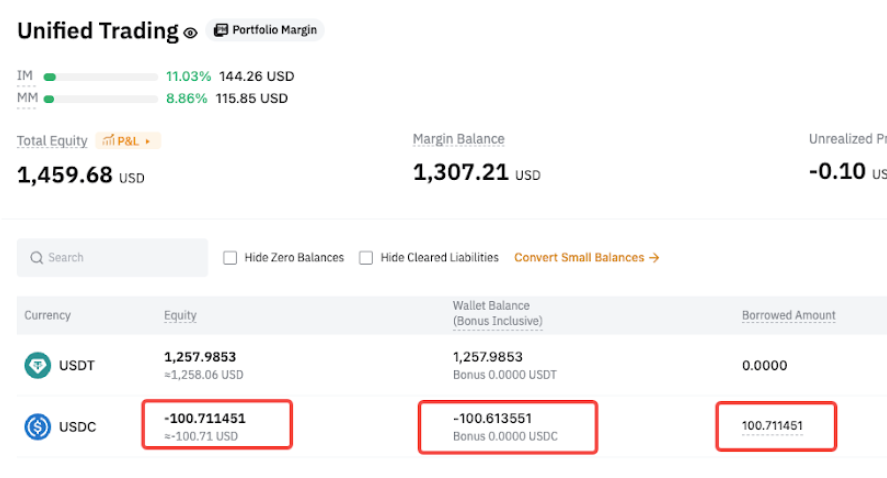

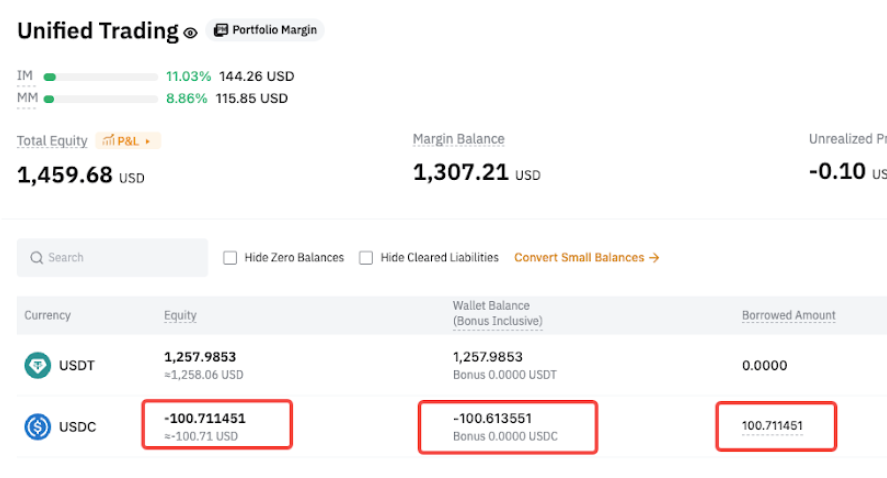

Contoh Jumlah pinjaman = 100.711451

Setelah transfer masuk USDC, semua liabilitas dilunasi secara otomatis. - Ekuitas USDC = 0

- Saldo dompet USDC = 0

- Jumlah pinjaman USDC = 0

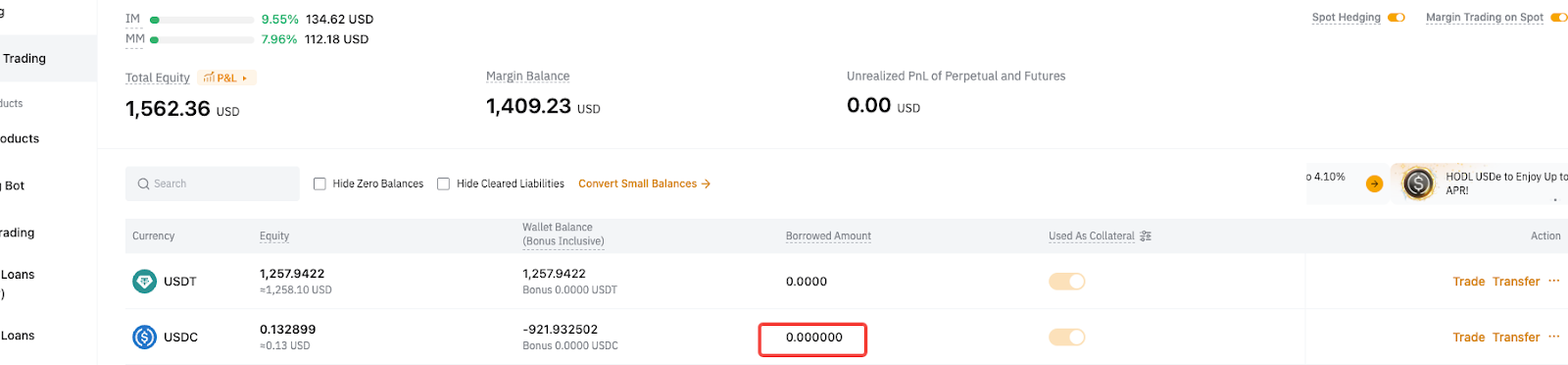

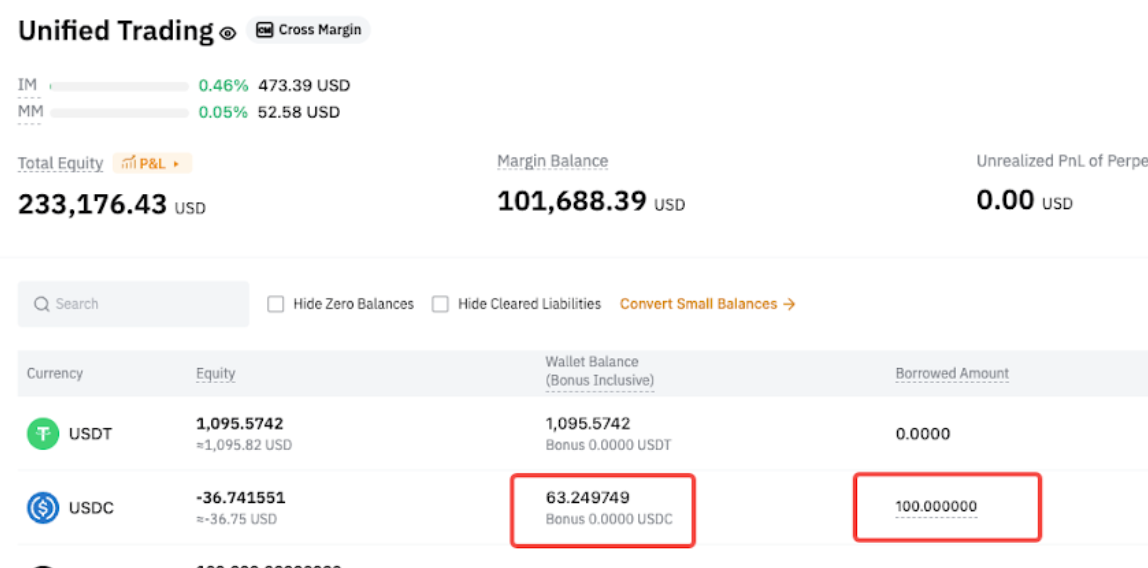

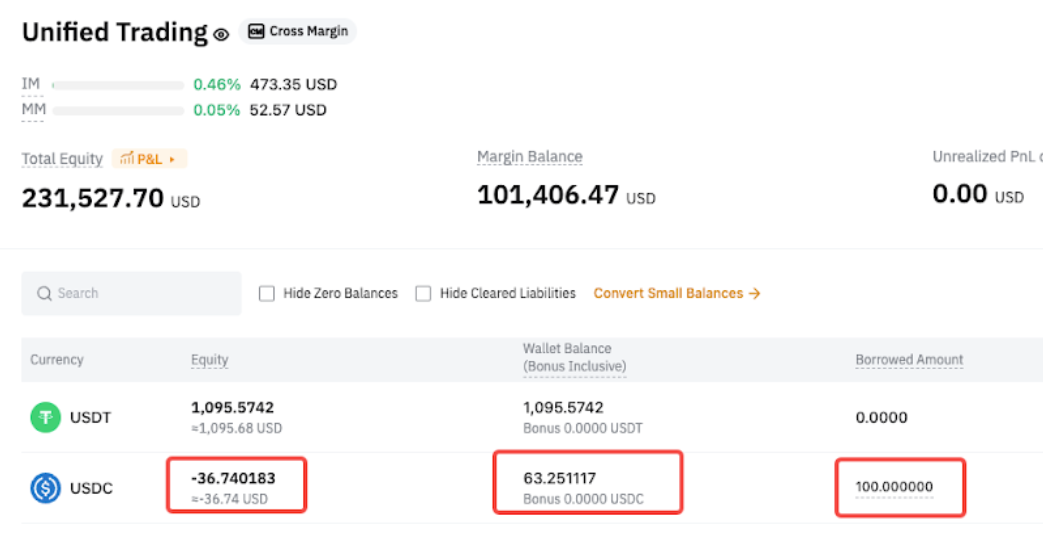

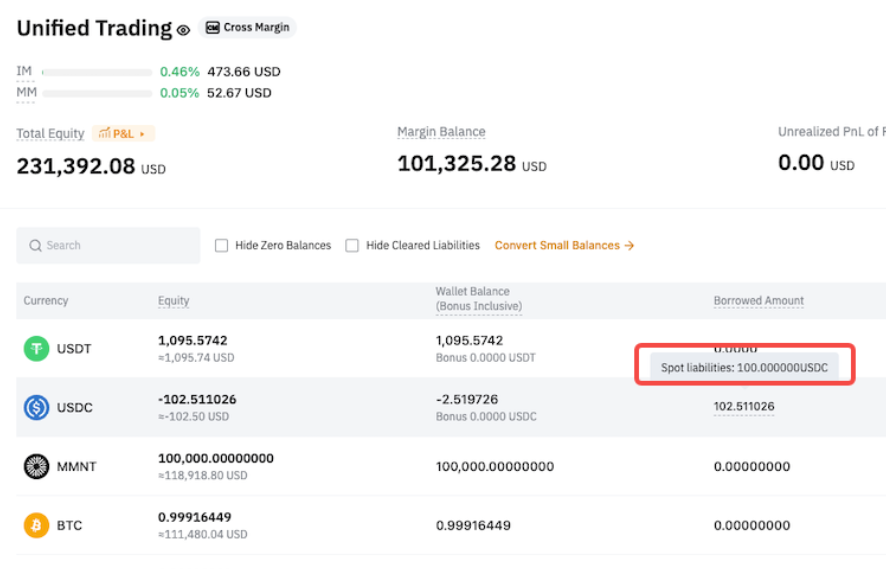

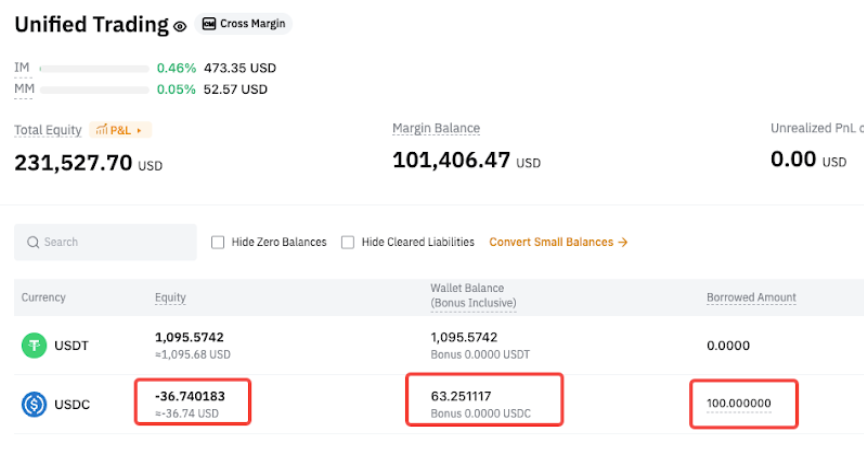

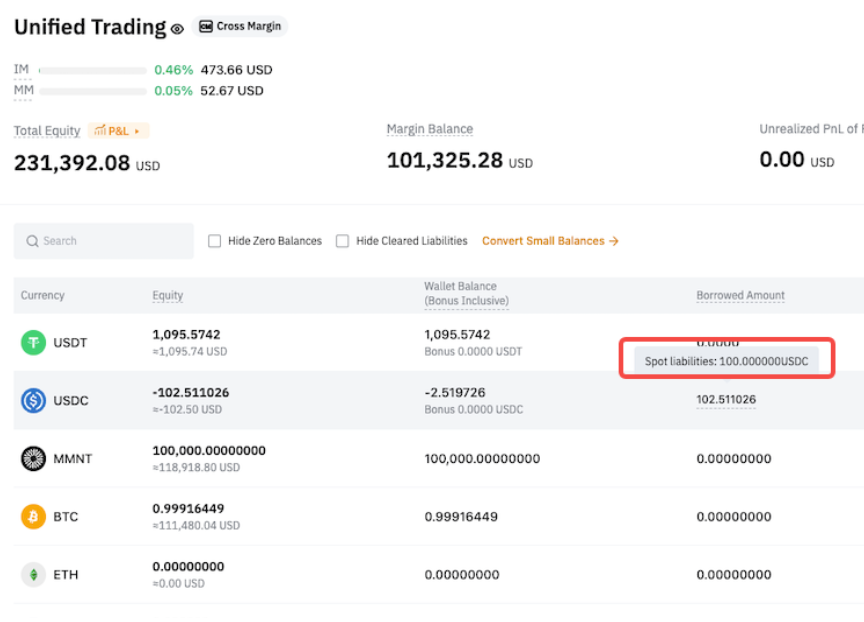

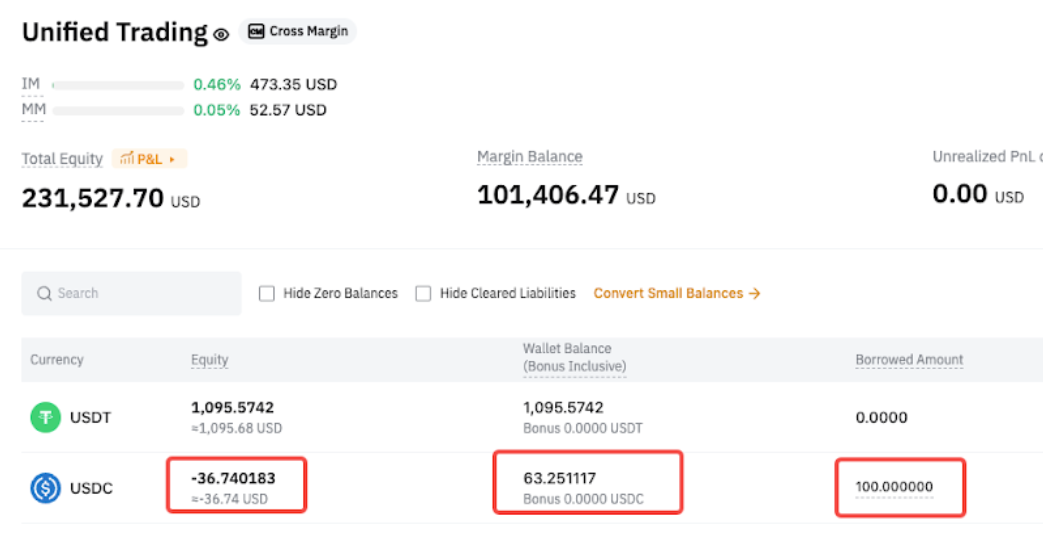

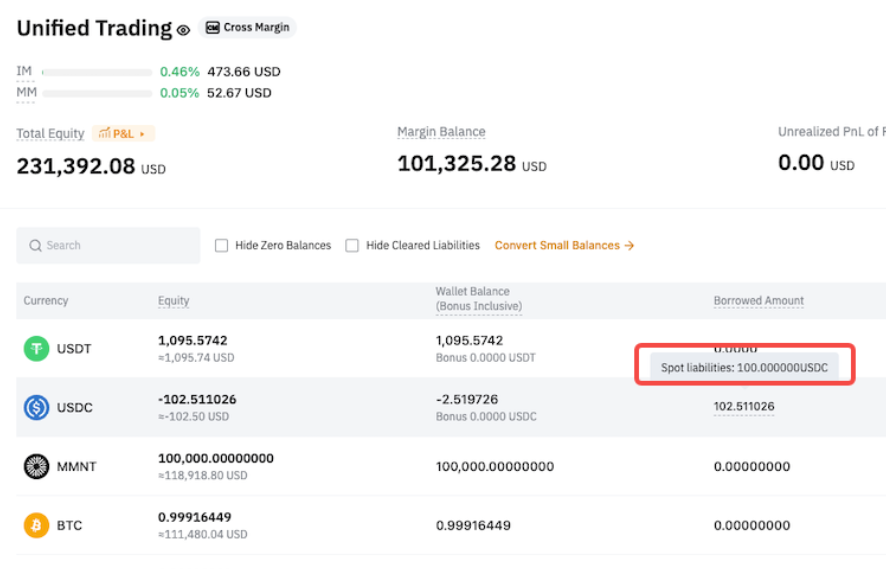

| Contoh Total jumlah pinjaman = 102.511026 - Liabilitas spot = 100

- Liabilitas derivatif = 2,511026

Setelah transfer masuk USDC, hanya liabilitas Derivatif yang dilunasi secara otomatis, sedangkan liabilitas Spot tetap terutang. - Liabilitas spot = 100

- Ekuitas USDC = -36,740183

- Saldo dompet USDC = 63,25117

- Jumlah pinjaman USDC = 100

|

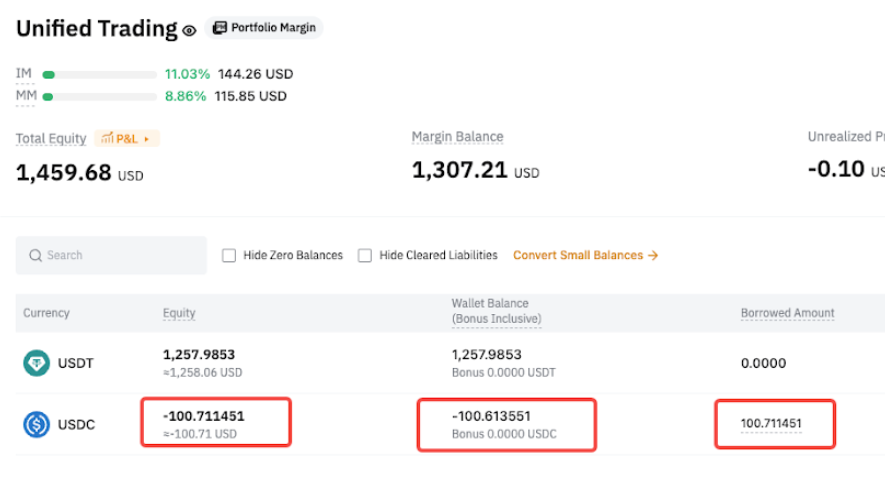

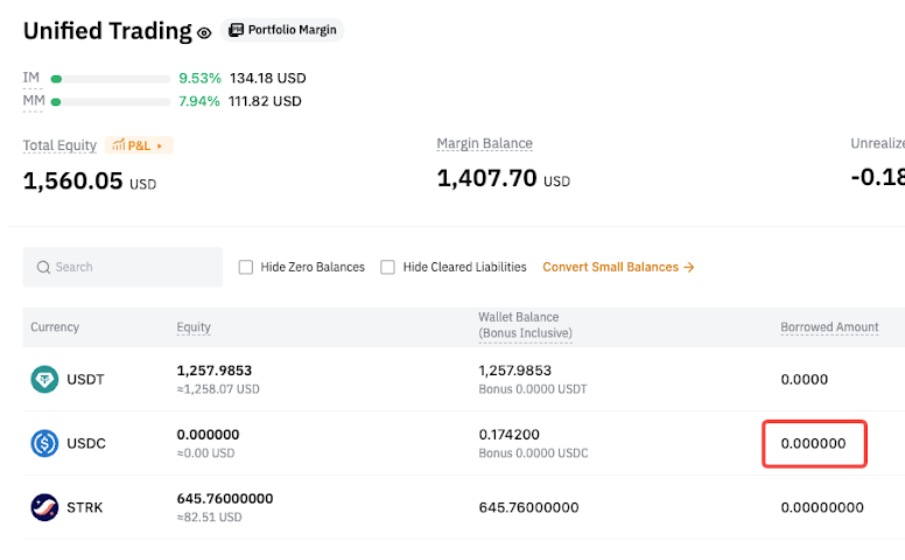

Pelunasan oleh Perdagangan Spot

Misalnya, jika Anda meminjam BTC tetapi saat ini tidak memilikinya, membeli BTC dengan USDT melalui pasangan Spot BTC/USDT akan secara otomatis dihitung sebagai pelunasan. BTC yang Anda terima diperlakukan seolah-olah ditransfer ke Akun Perdagangan Terpadu Anda.

Sebelum Peningkatan | Setelah Peningkatan |

Koin transfer digunakan untuk melunasi liabilitas Spot dan Derivatif. | Koin transfer hanya digunakan untuk melunasi liabilitas Derivatif. Liabilitas spot tetap terutang dan harus dilunasi secara manual. |

Contoh Jumlah pinjaman = 100.711451

Setelah transfer masuk USDC, semua liabilitas dilunasi secara otomatis. - Ekuitas USDC = 0

- Saldo dompet USDC = 0

- Jumlah pinjaman USDC = 0

| Contoh Total jumlah pinjaman = 102.511026 - Liabilitas spot = 100

- Liabilitas derivatif = 2,511026

Setelah transfer masuk USDC, hanya liabilitas Derivatif yang dilunasi secara otomatis, sedangkan liabilitas Spot tetap terutang. - Liabilitas spot = 100

- Ekuitas USDC = -36,740183

- Saldo dompet USDC = 63,25117

- Jumlah pinjaman USDC = 100

|

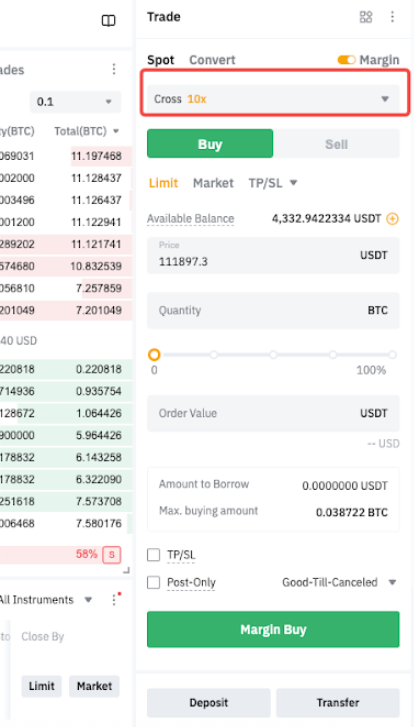

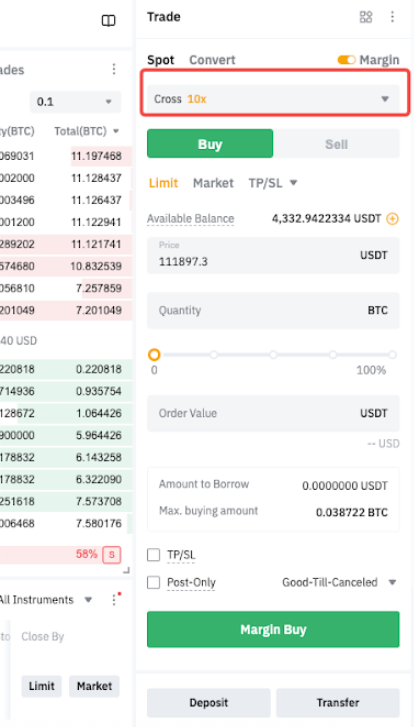

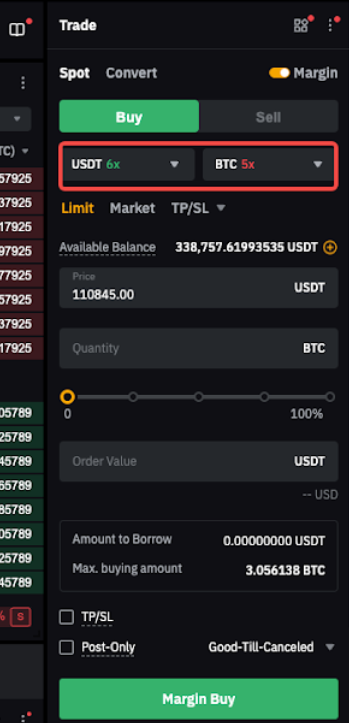

Tingkat Margin Pemeliharaan (MMR) dan Leverage

| Sebelum Peningkatan | Setelah Peningkatan |

Leverage untuk Pinjaman | Berlaku untuk semua pasangan perdagangan. Leverage maksimum adalah 10x untuk semua pasangan.

| Leverage berbasis koin, dengan leverage maksimum yang bervariasi berdasarkan koin dan tingkatan posisi.

Tingkatan posisi ditentukan oleh jumlah pinjaman Anda untuk setiap koin. Untuk detail selengkapnya, silakan lihat di sini.

|

MMR untuk Jumlah Pinjaman | Ditetapkan sebesar 4% | MMR bertingkat berdasarkan koin dan tingkatan posisi.

Tingkatan posisi ditentukan oleh jumlah pinjaman Anda untuk setiap koin. Untuk detail selengkapnya, silakan lihat di sini.

|

API

Fitur | Sebelum Peningkatan | Setelah Peningkatan |

Pinjaman Manual | Tidak didukung | POST /v5/account/borrow |

Pelunasan | Hanya pelunasan penuh koin tunggal yang didukung, atau Anda dapat melunasi semuanya dengan mengonversi aset jaminan. | Sistem akan menggunakan koin pinjaman yang tersedia terlebih dahulu, lalu mengonversi jaminan untuk membayar sisa liabilitas.

Endpoint tambahan akan dimasukkan untuk memungkinkan pelunasan penuh atau sebagian. |

Pengaturan Leverage untuk Perdagangan Margin Spot | Didukung. Pengaturan leverage berlaku untuk semua koin. | Didukung. Pengaturan leverage berbasis koin. |

Jumlah Maksimum yang Dapat Dipinjam Kueri | Tidak didukung | GET /v5/spot-margin-trade/max-borrowable |

Tingkatan Posisi Kueri | Tidak didukung | GET /v5/spot-margin-trade/position-tiers |

Koin Pinjaman Tersedia Kueri | Tidak didukung | GET /v5/spot-margin-trade/repayment-available-amount |

Leverage Maksimum per Koin Kueri | Tidak didukung | GET /v5/spot-margin-trade/coinstate |