Fitur Trailing Up memungkinkan Bot Grid Spot untuk menggeser rentang trading ke atas secara otomatis guna merespons kenaikan harga pasar. Kemampuan untuk beradaptasi secara dinamis terhadap pergerakan harga ini membantu mengatasi keterbatasan utama trading grid tradisional — di mana keuntungan kerap terhenti begitu harga keluar dari kisaran yang ditetapkan — dan memungkinkan Anda untuk memperoleh keuntungan tambahan di luar batasan grid asli Anda.

Cara Kerjanya

Ketika harga pasar bergerak satu grid di atas harga batas atas, fitur Trailing Up akan membatalkan pesanan beli terendah dan membuat pesanan beli baru pada batas atas sebelumnya. Jika harga terus naik melampaui batas atas yang baru ditambah interval harga, bot akan mengulangi proses tersebut — menggeser rentang trading satu grid ke atas — untuk membantu Anda mengikuti momentum kenaikan pasar.

Mari memahami prosesnya menggunakan contoh berikut.

- Batas harga bawah: $25.000

- Batas harga atas: $30.000

- Harga pasar: $26.500

- Jumlah grid: 5

- Interval harga: $1.000

Bot akan menempatkan pesanan beli dan jual secara merata di seluruh rentang harga berdasarkan interval.

Saat Trailing Up dinonaktifkan:

Jika harga pasar melampaui batas atas ($30.000), bot akan berhenti membuat pesanan baru sampai harga kembali bergerak dalam rentang tersebut.

Saat Trailing Up diaktifkan:

Ketika harga pasar mencapai atau melebihi $31.000 (batas atas + interval), bot akan menggeser rentang satu grid ke atas, membatalkan pesanan beli terendah pada harga $25.000, dan membuat pesanan beli baru pada harga $30.000 (batas atas sebelumnya).

Jika harga terus naik melewati $32.000 ($31.000 + $1.000), bot akan menggeser rentang ke atas lagi. Rentang yang baru menjadi $27.000 hingga $32.000.

Dalam contoh ini, rentang trading bergeser dua kali, jadi jumlah Trailing Up adalah 2.

Catatan:

—Trailing Up hanya berfungsi jika dua kondisi berikut terpenuhi: (1) terdapat setidaknya lima grid, dan (2) terdapat saldo yang cukup untuk membuat pesanan baru pada harga yang lebih tinggi. Saldo ini mencakup keuntungan grid yang terakumulasi dan dana yang dirilis dari pesanan yang dibatalkan.

— Fitur ini dapat menghasilkan pembelian dengan harga tinggi selama pembalikan pasar. Untuk mengelola risiko dengan lebih efektif, kami sarankan Anda untuk menggunakannya dengan fitur Trailing Stop.

Mekanisme Pesanan Dinamis

Dengan Bot Grid Spot Bybit, setiap grid menampung jumlah aset dasar yang sama (misalnya, BTC dalam pasangan trading BTC/USDT), berapa pun harganya. Misalnya, bot akan membeli atau menjual 1 BTC di setiap level, terlepas dari ketika harganya $30.000 atau $35.000. Ketika harga naik, nilai total setiap grid pun ikut naik.

Jika dana tidak cukup untuk membuat pesanan baru selama penyesuaian trailing up, bot akan membatalkan satu atau lebih pesanan yang dibuat pada harga terjauh dari harga pasar saat ini sampai dana yang cukup tersedia. Ini dikenal sebagai mekanisme pesanan dinamis. Mekanisme ini membantu meningkatkan efisiensi modal dengan membebaskan dana dari pesanan yang kurang efektif saat pasar berubah. Akibatnya, jumlah grid dapat bervariasi — bisa sama dengan atau kurang dari jumlah grid asli.

Akan tetapi, jika pembatalan pesanan mengurangi jumlah grid di bawah 5, bot tidak akan membatalkan pesanan apa pun atau melanjutkan. Sebaliknya, ia akan menunggu dan mencoba lagi setelah dana yang cukup tersedia.

Cara Mengaktifkan Trailing Up di Bot Grid Spot

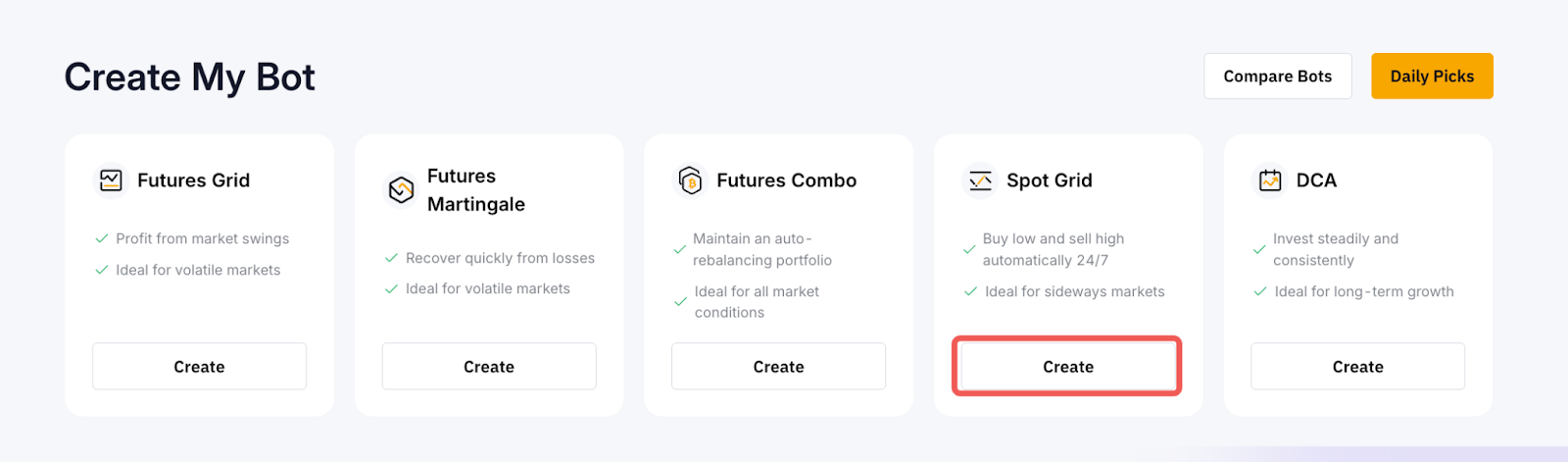

Langkah 1: Buka halaman Bot Trading Bybit dan klik Buat di bagian Grid Spot.

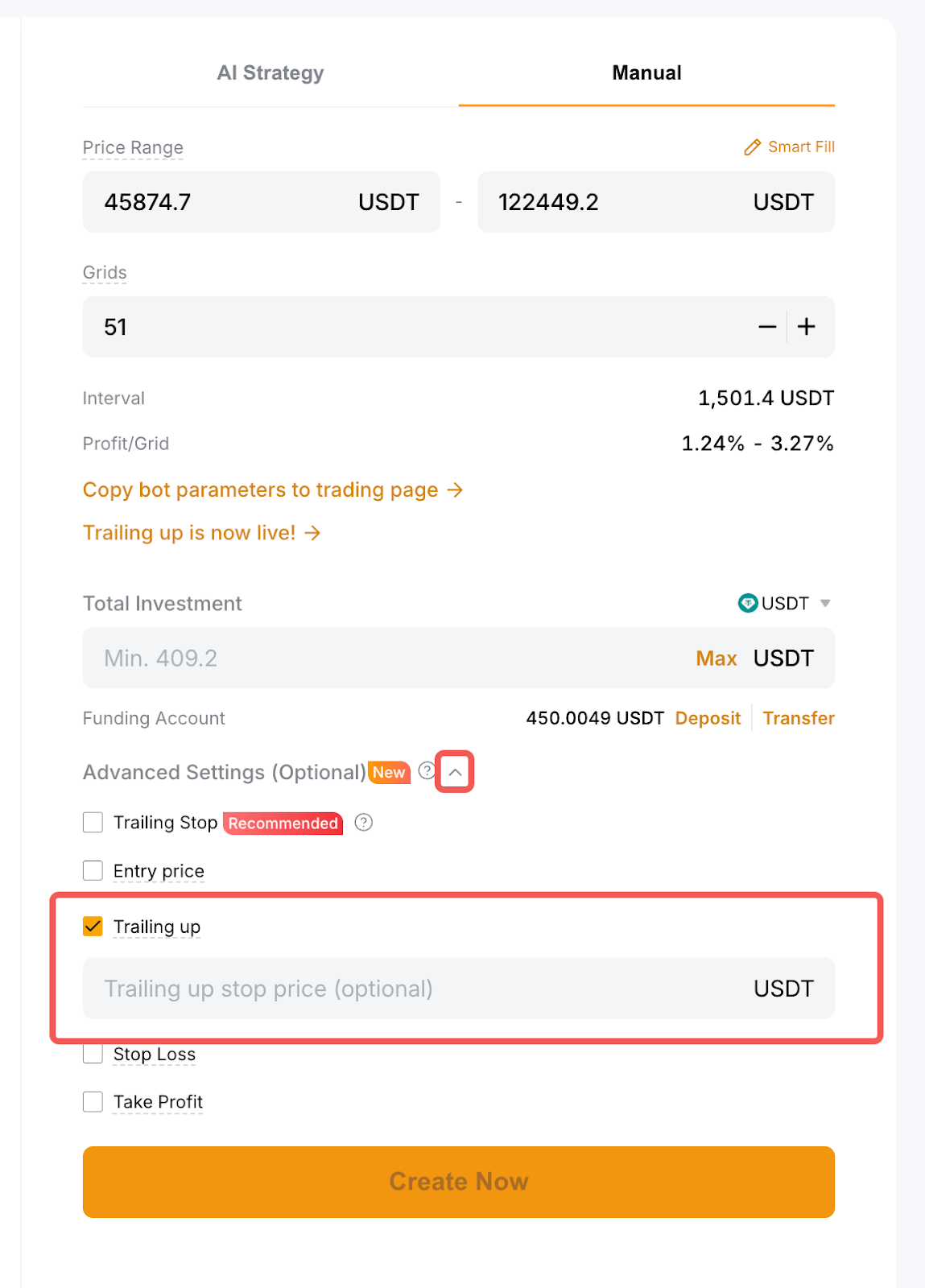

Langkah 2: Pilih tab Strategi AI atau Manual. Pada Pengaturan Lanjutan (Opsional), centang kotak Trailing Up dan tetapkan harga batas trailing up jika diperlukan.

Catatan: Harga batas trailing up menentukan titik di mana bot berhenti menyesuaikan grid ke atas. Jika tidak diatur, bot akan terus berjalan hingga dana tidak cukup untuk mempertahankan lima pesanan.

Langkah 3: Selesaikan sisa pengaturan seperti biasa, lalu klik Buat Sekarang.

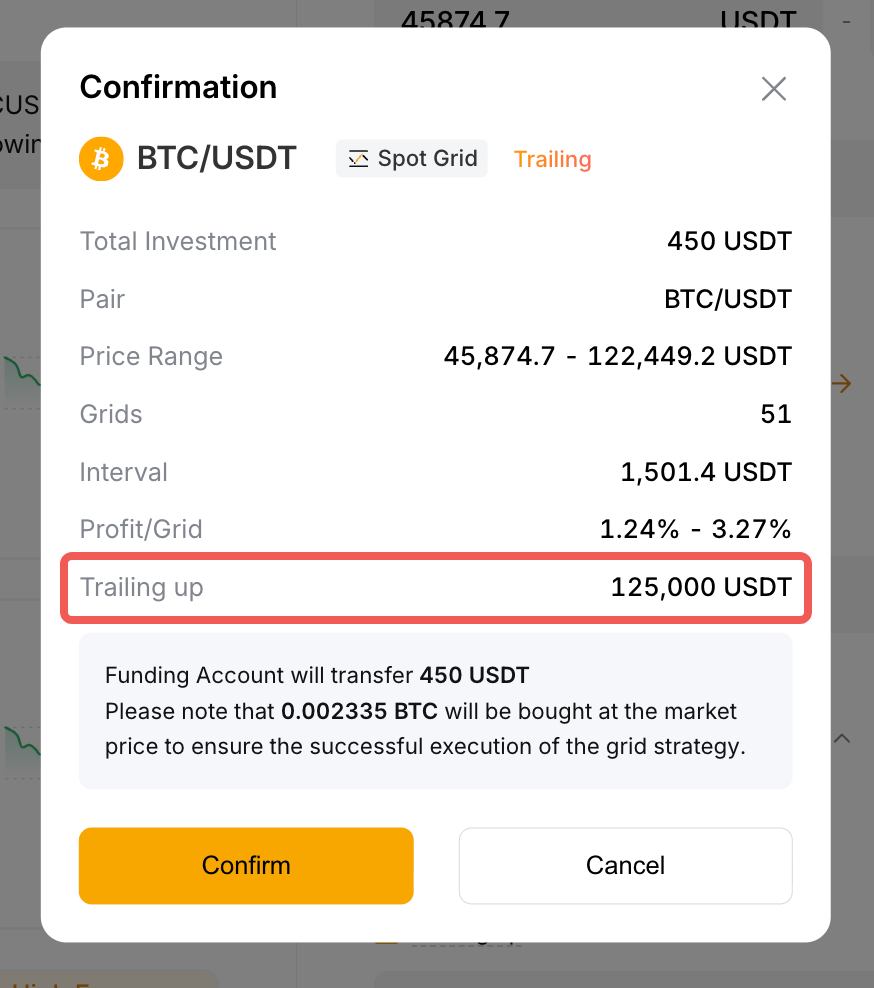

Langkah 4: Pada pop-up Konfirmasi, tinjau semua pengaturan Anda, termasuk opsi Trailing Up, lalu klik Konfirmasi.

Untuk memeriksa rentang harga asli dan yang disesuaikan, serta batas harga trailing up jika Anda telah menetapkannya, cukup buka Lihat Bot Saya → Aktif → Grid Spot → Detail → Parameter. Anda juga dapat membuat perubahan di sini jika diperlukan.